Dr Rajiv Desai

An Educational Blog

Critical Minerals

Critical Minerals:

_

Tesla would not go out of business if supplies of cobalt vanished. But without it, the current generation of electric vehicles would not be able to drive as far between charges or remain in service as long without replacing the batteries.

_

Section-1

Prologue:

Archaeologists and historians describe early civilizations and periods of human history using terms such as the Stone Age, the Copper Age, the Bronze Age, and the Iron Age. Such descriptions reflect the fundamental importance of nonfuel minerals, metals, and materials technology and applications. Early civilizations were built to a significant degree using the seven metals of antiquity (in order of discovery): gold (6000 BC), copper (4200 BC), silver (4000 BC), lead (3500 BC), tin (1750 BC), iron (1500 BC), and mercury (750 BC). Each discovery led to a range of innovations and applications that provided a marked advantage until such time as it was adopted by competing civilizations or overtaken by other innovations. Advances were not limited to military technology but extended to agricultural implements, food storage and preparation, therapeutic and cosmetic applications, and many other aspects of daily life and culture. The much later discovery of arsenic, antimony, zinc, and bismuth in the thirteenth and fourteenth centuries was followed by platinum in the sixteenth century and another 12 metals or metalloids in the eighteenth century, bringing the total number of known metals and metalloids to 24. Most known metals and metalloids were discovered only in the past two centuries.

_

Minerals are solid, naturally occurring inorganic substances with a definite chemical composition and a crystalline structure that can be found in the earth’s crust. Minerals can contain a combination of metallic, non-metallic, and metalloid elements. Metals are elementary substances, such as gold, silver and copper that are crystalline when solid and good conductors of heat and electricity, occurring naturally in minerals. Many minerals contain metals as their primary or secondary constituents. For example, the mineral galena (PbS) contains the metal lead, and the mineral hematite (Fe2O3) contains the metal iron. Metals are often extracted from minerals through processes like smelting, leaching, or other metallurgical techniques. Non-metallic minerals are those that lack metallic properties, meaning they are poor conductors of heat and electricity, not malleable, and break down easily. Examples include salt, mica, quartz, limestone, and clay. Metalloids have properties of both metals and nonmetals. Silicon is not a metal, but it is a metalloid. It is brittle at room temperature, which is a property of nonmetals. It is an intrinsic semiconductor, which is not a property of metal. Silicon dioxide, or silica, is a very common compound in the Earth’s crust, forming rocks and minerals like quartz and sand. Metalloids can be found in various minerals, and some minerals are even named after them, such as arsenopyrite (containing arsenic) and stibnite (containing antimony).

_

A critical mineral is a nonfuel mineral that is essential for use and faces considerable supply chain vulnerabilities. For example, silicon is essential for manufacturing computer chips; lithium is essential for manufacturing batteries; and rare earth elements are essential for manufacturing magnets, batteries, phosphors, and catalysts used in such products as wind turbines, electric vehicles, screens/touchscreens, and petroleum refining. Demand for these components in the health care, transportation, power generation, consumer electronics, defense, and refining and manufacturing sectors is projected to grow in the next decade, likely leading to increased demand for critical mineral resources. The definition of whether a mineral is considered critical or not is somewhat flexible, since this classification depends on not only the context and the stakeholder’s point of view, but is also subject to change over time because the current techno-socio-economic paradigm largely defines the criticality level of minerals. Just as oil was key to progress during the last century, critical minerals are crucial to this century’s energy transition. Some trade experts call critical minerals the “bedrocks” of a new era in technological advancement — not unlike how the invention of the steam engine during the first industrial revolution dramatically changed the world, powering boats, trains and factory machines. Growing dependency on critical minerals is leading to anxieties over continuing supply and the geopolitical influence they bestow.

_

What does your smartphone have in common with a solar panel, or an EV battery, or a piece of military equipment? They’re all made using critical minerals — an essential ingredient in powering the modern technology that we use every day. In recent years, the concept of critical minerals has gained popularity because the new technologies that are shaping the ongoing green and digital transitions (together known as the ‘twin transition’) utilise far higher amounts of minerals than more traditional technologies. For example, the construction of a wind farm requires nine times more minerals than that of a natural gas power plant, and the manufacturing process to build an electric car needs six times more minerals than that of a gasoline-powered car. In another powerful comparison, the photovoltaic energy is portrayed as requiring up to 40 times more copper than the fossil-fuel combustion. Furthermore, the construction of wind farms and electric cars use seven different types of minerals, while a natural gas power plant and a conventional car use only two. Manufacturing a single electric car, for example, requires more than 200 kilograms of combined copper, lithium, nickel, manganese, cobalt, graphite and rare earth elements, compared to less than 35 kilograms of just copper and manganese for an internal combustion model. The IEA forecasts that meeting the Paris climate agreement’s goal of keeping average global warming well below 2ºC above pre-industrial temperatures will result in a quadrupling of demand for critical minerals by 2040. Achieving net-zero emissions by 2050 would mean a sixfold increase. Thus, while previously the energy sector represented only a small portion of the total minerals demand, it is emerging as the major force in mineral markets and as a result of this transformation, minerals bring new challenges to the energy security. Although the metal-intensive transition to the net-zero economy will reduce dependencies on conventional hydrocarbon resources, it may lead to new and unanticipated interdependencies, including dependencies on raw materials.

_

The criticality level of minerals is usually determined by the economic importance of the minerals and the risk of disruption to their supply chains. From the ‘twin transition’ perspective, a mineral’s economic importance depends on how relevant it is for producing new technologies, while the supply chain disruption risk refers to the likelihood of a shortage due to a mineral’s physical scarcity or market concentration. The reason why the supply chains of critical minerals are so complex is that disruption risks can emerge from different stages of the supply chains. Some minerals are critical because they are present in minimum concentrations as by-products of so-called ‘major’ minerals (minerals that are present in higher concentrations in mineral deposits); for example, ruthenium, rhodium and palladium are by-products of platinum. Other minerals are critical due to market concentration in the downward processing stages; for instance, over 40% of the global smelting and refining capacity for copper, lithium, rare earths and cobalt is concentrated in China. While not geologically scarce, critical minerals are already in short supply. This stems from their versatility as integral components of nearly all modern technologies — not only within clean tech, but also in consumer electronics, communications and medical equipment, advanced weapons systems and the supercomputers needed to develop artificial intelligence (AI). Some large deposits of critical minerals are also hard to access, given their location in increasingly fragile states. All of these different factors make this subject an undoubtedly fascinating one to study.

_

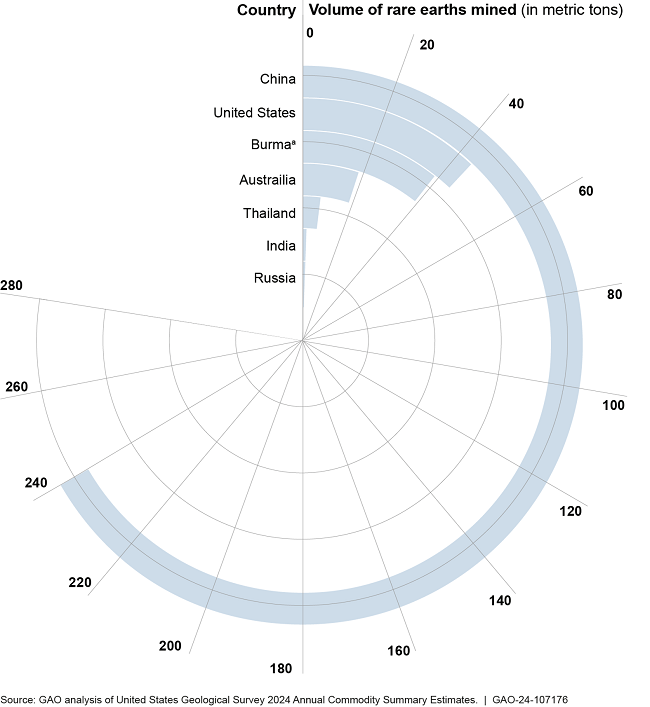

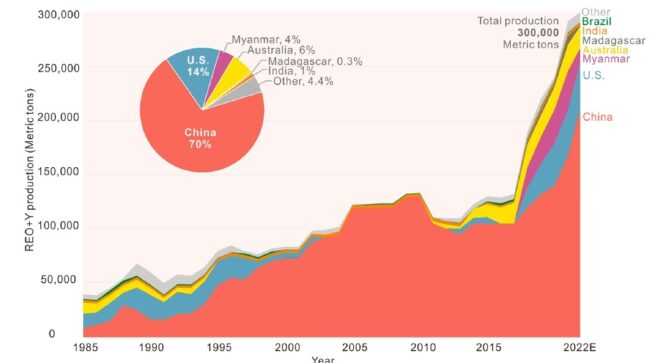

Mining is the foundation that allowed the United States to be a military leader, providing the minerals needed to manufacture tanks, missiles, fighter jets, and warships. But as with everything else in today’s world, these weapons now require computerised systems and increasingly AI to operate, and this requires access to minerals that were only of limited importance in the past. Today the United States is 100 percent import-reliant for 12 of the 50 minerals identified as critical by the US Geological Survey (USGS) and over 50 percent import-reliant for another 29. China is the top producer for 29 of these critical minerals. China has a stranglehold on minerals processing, refining between 40 and 90 percent of the world’s supply of rare elements, graphite, lithium, cobalt, and copper. According to the International Energy Association, China is responsible for 63% of the world’s rare earth elements, including 45% of molybdenum. Additionally, China has acquired a majority stake in the Cobalt mines of the Democratic Republic of Congo, which accounts for 70% of the world’s output. Notably, China is a significant importer of lithium, with up to 55% of production occurring in Australia. While Australia is the leading lithium producer globally, more than 99% of the value in lithium battery production is added during chemical processing, cell manufacturing, and assembly, currently dominated by China. South Africa mines 72% of the world’s platinum and Indonesia is the largest producer of nickel.

_

From smart phones and laptops, to batteries and solar panels, cosmetics and medical devices, we rely on critical minerals every day. Critical minerals sustain the nation’s infrastructure and manufacturing, and are essential to scaling up and advancing modern technologies, including but not limited to those related to communications, national security and energy generation & storage. Critical minerals play a vital role in the economic and national security of both industrialized nations and developing countries. These minerals serve as the foundational elements for essential modern technologies in various sectors, including energy, communication, space exploration, nuclear industry, manufacturing of mobile phones, computers, batteries, electric vehicles, solar panels, wind turbines, and more. Studying critical minerals is vital because they underpin modern technology, energy transition, and national security, making their understanding essential for economic development, technological advancement, and global stability.

______

______

Abbreviations and synonyms:

CM = Critical Mineral

CMM = Critical Minerals and Materials

CRM = Critical Raw Materials

3Ts = tin, tungsten, and tantalum

ASM = artisanal and small-scale mining

DRC = Democratic Republic of the Congo

ENAMI = Empresa Nacional de Minería

EU = European Union

GHG = greenhouse gas

IEA = International Energy Agency

IRENA = International Renewable Energy Agency

IGF = Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development

IPCC = Intergovernmental Panel on Climate Change

OECD = Organisation for Economic Co-operation and Development

MSP = Mineral Security Partnership

REE = Rare Earth Elements

ESS = Energy Storage Systems

GW = Gigawatts

EV = Electric Vehicle

PGE = Platinum Group Elements

PGM = Platinum group minerals

AMD = Acid Mine Drainage

USGS = United States Geological Survey

GSI = Geological Survey of India

PSU = Public Sector Undertaking

R&D = Research & Development

LIB = lithium-ion battery

LFP = lithium- iron-phosphate (LiFePO4)

REO = rare earth oxides

ESG = environmental, social, and governance

_____

_____

Section-2

Metals and minerals:

The Earth’s crust is the outermost layer of the Earth made of rocks, minerals, and metals. It’s the thinnest layer of the Earth, but it’s where most geological processes occur. The crust is broken into tectonic plates that move over time, which shapes the Earth’s surface. The two elements that make up about 75% of Earth’s crust are silicon and oxygen. The average thickness of the crust is about 15 – 20 km.

_

Minerals are naturally occurring elements or compounds that have been formed through slow inorganic processes and occur in the earth’s crust. The earth’s crust is composed of many kinds of rocks, each of which is an aggregate of one or more minerals. In geology, the term mineral describes any naturally-occurring inorganic solid substance with a specific composition and crystal structure. A mineral’s composition refers to the kinds and proportions of elements making up the mineral. The way these elements are packed together determines the structure of the mineral. More than 3,500 different minerals have been identified. There are only 12 common elements (oxygen, silicon, aluminum, iron, calcium, magnesium, sodium, potassium, titanium, hydrogen, manganese, phosphorus) that occur in the earth’s crust. They have abundances of 0.1 percent or more (more than1,000 ppm). All other naturally occurring elements are found in very minor or trace amounts. Remember – all the minerals are non-renewable.

_

Silicon and oxygen are the most abundant crustal elements, together comprising more than 70 percent by weight. It is therefore not surprising that the most abundant crustal minerals are the silicates (e.g. olivine, Mg2SiO4), followed by the oxides (e.g. hematite, Fe2O3). Other important types of minerals include: the carbonates (e.g. calcite, CaCO3) the sulfides (e.g. galena, PbS) and the sulfates (e.g. anhydrite, CaSO4). Most of the abundant minerals in the earth’s crust are not of commercial value. Economically valuable minerals (metallic and nonmetallic) that provide the raw materials for industry tend to be rare and hard to find. Therefore, considerable effort and skill is necessary for finding where they occur and extracting them in sufficient quantities.

_

Mineral resources are essential to our modern industrial society and they are used everywhere. For example, at breakfast you drink some juice in a glass (made from melted quartz sand), eat from a ceramic plate (created from clay minerals heated at high temperatures), sprinkle salt (halite) on your eggs, use steel utensils (from iron ore and other minerals), read a magazine (coated with up to 50% kaolinite clay to give the glossy look), and answer your cellphone (containing over 40 different minerals including copper, silver, gold, and platinum). We need minerals to make cars, computers, appliances, concrete roads, houses, tractors, fertilizer, electrical transmission lines, and jewellery. Without mineral resources, industry would collapse and living standards would plummet. In 2010, the average person in the U.S. consumed more than16,000 pounds of mineral resources. With an average life expectancy of 78 years, that translates to about1.3 million pounds of mineral resources over such a person’s lifetime. Here are a few statistics that help to explain these large values of mineral use: an average American house contains about 250,000 pounds of minerals, one mile of Interstate highway uses 170 million pounds of earth materials, and the U.S. has nearly 4 million miles of roads. All of these mineral resources are nonrenewable, because nature usually takes hundreds of thousands to millions of years to produce mineral deposits. Early hominids used rocks as simple tools as early as 2.6 million years ago. At least 500,000 years ago prehistoric people used flint (fine-grained quartz) for knives and arrowheads.

_

Note:

In the realm of health and nutrition, the terms electrolytes and minerals are often used interchangeably, leading to confusion among consumers and even professionals. While all electrolytes are minerals, not all minerals are electrolytes. Electrolytes are minerals that can carry an electrical charge when dissolved in water. They include sodium, potassium, chloride, magnesium, calcium, and phosphorus.

_____

_____

Find out what is the difference between ore, metal, minerals and rocks:

A geologist defines a mineral as a naturally occurring inorganic solid with a defined chemical composition and crystal structure (regular arrangement of atoms). Minerals are the ingredients of rock, which is a solid coherent (i.e., will not fall apart) piece of planet Earth. There are three classes of rock, igneous, sedimentary, and metamorphic. Igneous rocks form by cooling and solidification of hot molten rock called lava or magma. Lava solidifies at the surface after it is ejected by a volcano, and magma cools underground. Sedimentary rocks form by hardening of layers of sediment (loose grains such as sand or mud) deposited at Earth’s surface or by mineral precipitation, i.e., formation of minerals in water from dissolved mineral matter. Metamorphic rocks form when the shape or type of minerals in a preexisting rock change due to intense heat and pressure deep within the Earth.

_

All materials – including fuel, water, metals etc. – needed by modern society are derived from the earth’s crust. The raw material from which minerals are extracted is known as ore. Ore is sediment that contains one or more valuable minerals, typically metals, that can be mined, treated and sold at a profit. Ore is extracted from the earth through mining and treated or refined, often via smelting, to extract the valuable metals or minerals.

Minerals are obtained from the ground by a process known as ‘mining’. There are two types of mining; surface mining and subsurface mining.

Some minerals are extracted from the earth’s surface. When the ore deposits are very large, a huge pit is created as excavating machines scrape off the earth to reach the mineral ore. The ore is then taken away to be refined. The size of the ore bed increases as mining continues, and eventually, the pit becomes a very large bowl-shaped hole in the earth’s surface.

Sometimes, the ore is found in a very wide area but it’s not very deep in the ground, the method used to remove the ore is known as strip mining. Instead of creating one large pit in the ground, long, narrow trenches are dug out. Once the ore is removed, the soil dug out is dumped back into the strip, filling up the trenches.

Some minerals are found very deep below Earth’s surface. To remove these minerals from the ground, subsurface mining is employed. First, a deep hole is dug, at the end of which long tunnels are created horizontally in all directions. Usually, the ore is embedded in rocks, so one way is to blast apart the material and then send the ore pieces up to the surface. Another method is known as longwall mining, which is when mineral is sheared from the wall and collected on a conveyor belt to be taken up. This is a very efficient way of extracting mineral from an underground mine. Another method is solution mining, which is when hot water is injected into the ore to dissolve it. Once the ore is dissolved, air is pumped into it, and it’s bubbled up to the surface.

Huge quantities of ore are mined to obtain proportionately very small quantity of the pure mineral. For instance, only about 6% of ore is Copper; 40% to 70% Iron. Gold is so expensive because anywhere between 2 tons to 100 tons of ore is refined to produce 1 ounce of Gold!

The enrichment factor, which is the ratio of the metal concentration needed for an economic ore deposit over the average abundance of that metal in Earth’s crust, is listed for several important metal. Mining of some metals, such as aluminum and iron, is profitable at relatively small concentration factors, whereas for others, such as lead and mercury, it is profitable only at very large concentration factors. The metal concentration in ore can also be expressed in terms of the proportion of metal and waste rock produced after processing one metric ton (1,000 kg) of ore. Iron is at one extreme, with up to 690 kg of Fe metal and only 310 kg of waste rock produced from pure iron ore, and gold is at the other extreme with only one gram of Au metal and 999.999 kg of waste rock produced from gold ore.

And then, there is deep sea mining. Practically all of the mineral and energy resources found on land are present under the sea as well. Development, however, is limited by extraction costs that increase with depth of water, by the relative abundance of resources on land, and by political questions involving ownership of deep ocean resources.

This, in brief, is how minerals are obtained.

_____

Here is the difference among terms related to mining that can be easily mixed up:

Mineral:

Mineral is an inorganic solid and crystalline natural body formed as a result of physicochemical process interactions in geological environments. Each mineral is classified and named not only based on its chemical composition, but also in the crystalline structure of the materials that comprise it. To find out a mineral composition, a chemical and physical analysis is performed, which determines relative proportions of different chemical elements of that mineral and its crystalline structure (for instance, quartz, pyrite, hematite, etc.).

Rock:

Rocks are aggregates of one or more minerals. Thus, it can be stated that every rock is comprised by minerals. It is possible to find out what they are made of by means of analyzing their chemical or mineralogical composition. The latter expresses different mineral proportions that comprise the rock.

Ore:

It is a rich mineral aggregate in a specific mineral or chemical element that is economically or technologically viable for extraction (mining). Copper, for instance, occurs naturally in some rock types, but it is only possible to become an ore when it concentrates in large quantities and it is possible to be extracted from nature.

Metal:

Metals are elementary substances, such as gold, silver and copper. They are crystalline when solid and naturally occur in minerals. They are often good conductors of electricity and heat, shiny and malleable. The metals we use day-to-day are converted from metallic ores to their final form. This usually requires the use of chemicals and special technology.

____

Common Groups of Metals:

Metals are often grouped by their properties or function.

- Precious metals: This includes gold, silver, platinum and diamonds. About 90 per cent of the total gold production comes from gold mines. The remaining 10 per cent is produced as a by-product from mining other metals, such as copper and nickel. Precious metals are traded on world markets and used in a range of applications from jewellery to electronics to catalytic converters in cars.

- Base metals: This mainly means copper, lead and zinc, which have a lower value. Refined forms of these metals are commonly traded on world markets. These are the basic building materials for much of the world around us.

- Ferrous metals: Those with a high iron content, which includes all types of steel. Chromium, cobalt, manganese and molybdenum are commonly included in this group because their major use is to improve the properties of steel.

- Non-ferrous metals: This includes aluminium, copper, lead, magnesium, nickel, tin and zinc, since they have principal uses unrelated to steelmaking. Note that there is some overlap with the base metals group – the choice of the group depends on the context.

- Rare earth metals: These are not actually all that rare but their extraction is complex and difficult. They include scandium, yttrium, lanthanum and the 14 elements (lanthanides) following lanthanum in the periodic table. They have widespread uses, though in small volume, in the manufacturing of glass, ceramics, glazes, magnets, lasers and television tubes, as well as in refining petroleum.

- Alloys: These are made by mixing two or more metallic elements to form a new, unique substance that has differing chemical and physical properties to its component parts. Over 90 per cent of the metals in use today are alloys. Alloying elements are usually added to pure metals to enhance their strength or improve properties, such as corrosion resistance, wear resistance and ability to be cut. Demanding industrial requirements, such as extreme temperature resistance, strength for high-pressure applications, fatigue resistance, weight reduction or toughness, often in combination, have led to the development of a wide range of alloys.

The most common alloys are broadly classified as steels. These characteristically strong alloys, formed from iron and carbon, can be mixed with other elements to further improve performance and durability. For example, a car contains more than 10 different steel alloys for body parts, gears, drive trains, crankshafts, valves and so on.

____

The difference between Minerals and Metals:

- Metal is an element and mineral is a compound.

- Most metals are naturally present as minerals.

- Metals are reactive than minerals.

- Metal and the respective minerals of that metal have different appearances and other properties.

_

Some ores and minerals:

|

Aluminium |

Bauxite |

AlOx(OH)3-2x [where 0 < x < 1] [Al2 (OH)4 Si2O5] |

|

Iron |

Haematite |

Fe2O3 |

|

Copper |

Copper pyrites |

CuFeS2 |

|

Zinc |

Zinc blend/Sphalerite |

ZnS |

_____

As nonfuel minerals or materials, Critical Minerals and Materials (CMM) are essential to our modern economy and national security and have a supply chain vulnerable to disruption. In addition to REEs, CMM include aluminum (bauxite), antimony (Sb), arsenic (As), barite (BaSO4), beryllium (Be), bismuth (Bi), cesium (Cs), chromium (Cr), cobalt Cr), fluorspar (CaF2), gallium (Ga), germanium (Ge), graphite (natural), hafnium (Hf), helium (He), indium (In), lithium (Li), magnesium (Mg), manganese (Mn), niobium (Nb), platinum group metals, potash, rhenium (Re), rubidium (Rb), scandium (Sc), strontium (Sr), tantalum (Ta), tellurium (Te), tin (Sn), titanium (Ti), tungsten (W), uranium (U), vanadium (V), and zirconium (Zr). The average mean CMM concentration in carbon ore and select alternate materials is shown in Figure below.

Figure above shows comparison of critical minerals concentration in coal ore, sedimentary rock and phosphate rock.

_____

In summary:

-Minerals are naturally occurring, inorganic substances with a specific composition and structure. Minerals are the building blocks of rocks and ores.

-Rocks are made up of one or more minerals or mineraloids.

-Ores are rocks or minerals that contain economically valuable materials.

-Metals are pure elements extracted from ores. Metals are elements or alloys that have specific physical and chemical properties and are often derived from ores through extraction and refining processes.

_____

Economic value of minerals:

Minerals that are of economic value can be classified as metallic or non-metallic.

Metallic minerals are those from which valuable metals (e.g. iron, copper) can be extracted for commercial use. Metals that are considered geochemically abundant occur at crustal abundances of 0.1 percent or more (e.g. iron, aluminum, manganese, magnesium, titanium). Metals that are considered geochemically scarce occur at crustal abundances of less than 0.1 percent (e.g. nickel, copper, zinc, platinum metals). Some important metallic minerals are: hematite (a source of iron), bauxite (a source of aluminum), sphalerite (a source of zinc) and galena (a source of lead). Metallic minerals occasionally but rarely occur as a single element (e.g. native gold or copper).

Non-metallic minerals are valuable, not for the metals they contain, but for their properties as chemical compounds. Because they are commonly used in industry, they are also often referred to as industrial minerals. They are classified according to their use. Some industrial minerals are used as sources of important chemicals (e.g. halite for sodium chloride and borax for borates). Some are used for building materials (e.g. gypsum for plaster and kaolin for bricks). Others are used for making fertilizers (e.g. apatite for phosphate and sylvite for potassium). Still others are used as abrasives (e.g. diamond and corrundum).

_______

_______

A quick note on terminology on mineral production and reserves.

There are two forms of production.

The first is mine production. As the name suggests, this is what’s directly mined out of the ground. This is often impure and mixed with other minerals or rocks. It usually needs to be refined to get it into a usable or final form.

That’s the second form of production. Refined production is the conversion and separation of the raw mineral into a pure or final form used in manufacturing. And the countries that do the mining are often different from those doing the processing and refining. Technically speaking, processing is the first step in separating the valuable mineral, while refining is the process of further purifying and refining the concentrate for specific applications.

Another key metric to focus on is reserves. Reserves tell us how much known and assessed mineral deposits can be mined economically with current technologies and market conditions. These are not to be confused with “resources”, which describes the total amount of available minerals. Reserves are resources that are economically viable today. Both metrics — reserves and resources — can change over time as we find new deposits and known ones become more economical.

_______

_______

Heterogeneous distribution of metal resources:

The temporal evolution of the metallic mineral systems depends on cooling of a hot early Earth, its tectonic history, oxygen levels in the atmosphere, biogenic activity in the hydrosphere, and preservation conditions. Metallic mineral deposits are ∼10 to >10,000 times enriched in metal relative to crustal abundance and hence are rare, with mines exploiting mineral deposits occupying only about 0.02% of the Earth’s land surface. The deposits are part of larger scale mineral systems that require the rare conjunction of specific geodynamic, fertility, architecture, and preservation parameters that are related to the tectonic evolution of the continents and recycling of metals through the crust and mantle via the Earth’s unique subduction system. As each continent and country within it had its own tectonic history, the distribution of these rare metallic mineral deposits is incredibly heterogeneous. Countries or regions such as China, Russia, and Australia, and to a lesser extent western South America, Brazil, Canada, and South Africa, dominate global critical metal reserves and/or production. China is particularly well placed because it owns abundant critical metal deposits and obtains trace critical metals through processing of metallurgical by-products of global ores. Through its balanced energy policies, it dominates the clean energy industry. There is already evidence for the use of critical metals, particularly REEs, in trade disputes between the United States and China, and industrial weaponization of those metals and other energy sources is likely to become a future global problem as shortfalls in supplies increase. From a geoscience viewpoint, global exploration to provide a more homogeneous distribution of critical metal deposits is urgently required. However, it is hampered by increasing political and human rights issues and sovereign risks that are becoming more challenging for most major mining and exploration companies.

_

Scarce critical metal systems:

Scarce critical metals (Ni, Cu, Zn, Pb, Co, Li, Ga) have crustal abundances between 10 and 100 ppm. These metals rarely occur alone in any single mineral deposit of this group of metal systems. By contrast, they normally represent natural concentrations in multielement mineral systems that form in a wide range of tectonic settings including: (1) arc-related settings such as porphyry Cu and related skarn systems, (2) near craton margin settings such as mafic intrusion-related Ni-Cu±PGE and komatiite-hosted Ni-Cu systems, (3) submarine rift-related VMS Zn-Pb±Cu deposits, (4) IOCG Cu-Au deposits, (5) Li-Cs-Ta (LCT)-bearing pegmatites, (6) evaporite-related Li-rich brines, and (7) Ga specifically occurring as a by-product in mining of coal seams.

_

The future of metallic mineral resources and their exploration:

Since the Industrial Revolution, the increase in global population from about 1 to 8 billion has placed increasing pressure on metals supplied by mining and processing of metallic mineral deposits discovered by increasingly sophisticated exploration by professional mining and mineral exploration companies. Concern about climate change, promulgated by the UN-based IPCC, has led to Net Zero mitigation of CO2 policies which are attempting to transition from conventional energy supply to clean energy supply via technologies that require ever-increasing amounts of metals, particularly critical metals. There seems to be little political recognition that the metals that are the cornerstone of the so-called renewable energy transition are nonrenewable resources. In the past few years, there have been growing predictions that supply of these metals must increase between 100 and 1000%, dependent on the specific metal, with strong indications of short-term shortfalls and long-term indications that many critical metals may be highly depleted or exhausted at economically viable metal grades and increasing energy requirements during the first cycle of Net Zero remediations ending in 2050. The most obvious remedy is to discover more metallic mineral deposits through sophisticated global mineral exploration but there are increasingly serious natural, environmental, and social impediments to overcome. Add to this the large average times from deposit discovery to metal production, and it is self-evident that current mineral exploration discovery rate cannot alone solve the urgent problems of increasing metal demand and of metal deposit exhaustion. Recycling of metals from existing clean energy devices such as wind turbines, solar panels, and EVs, or better still manufacturing recyclable technologies, are other possibilities, but there is little progress. There is an urgent need to move to a circular economy in terms of critical metals where there is conservation of metals discovered by mineral exploration via manufacture of economically recyclable clean energy technologies and continuing recycling of those critical metals for the future. To preserve our materials-based civilization, it will be necessary to develop a balanced portfolio of energy sources, involving fossil fuels, nuclear fission and clean energy, while researching the use of hydrogen and nuclear fusion as potential future major energy sources. Without immediate action, Albert Einstein’s prediction that “I do not know with what weapons World War III will be fought, but World War IV will be fought with sticks and stones” may well become true.

______

______

Section-3

Introduction to critical minerals (CMs):

_

Humanity developed from bipedal hominidae via hunters and collectors to a modern high tech society in about 6 Ma. Survival was ensured by a thorough and sustainable use of the available resources during 5,999,750 a, which was learned and perfected during this evolution. In the last ~250 a, humanity left the path of sustainability in the Anthropocene and destabilized the global ecosystem to an extent, which endangers now the future of humanity itself.

The first use of stone tools dates back to 3.3 M years, where specific geological materials were selectively exploited for a specific hominin purpose (Harmand et al., 2015). This could be seen as the first mining activities of hominidae. The used resources during early evolution of hominidae were water and soil, and only the necessary extraction of geo-resources was performed in a sustainable way. With the discovery and use of fire about 790,000 years ago (Goren-Inbar, 2004), the flint stone business started to grow and enabling Homo erectus to expand its territories into colder climates. When hunting was successful, Homo neanderthalensis and Homo sapiens had meat for nutrition, and used the skin for clothing (~75,000 a), what enabled them to push the limit of their expansion even to more colder climates following their prey. Due to their success, they could start to enjoy their free time and used it for art work (Henshilwood et al., 2002) and made their homes cozier with artistic cave paintings (~35,000a). The related pigment mining (hematite) was started by Homo sapiens in Ngwenya mine, Swaziland where it was first dated to around 43,000 years ago. They also learned to use bones and tendons to produce weapons like spear, arc, and arrows to improve their success in hunting (16,000–18,000a). Again, specific geological materials like obsidian, flint or chert (silicified rocks) were used and mined for arrow heads and tools, a technological advancement for more efficiency in their survival strategies. From the hunted prey, everything was used, so that a very sustainable use of the natural resources was achieved. Nothing was defined as waste and human being were still part of a sustainable ecosystem.

_

With the end of the last Ice Age (around 12,000a), Homo sapiens started to settle down during the agricultural revolution (Harari, 2014) and first pottery were developed, requiring additional mining activities, in this case for clay, to supply the development of human civilization.

With the discovery of metallurgical processes to recover copper by smelting between the later Stone Age and early Bronze Age, named Chalcolithic Age or Copper Age, metal mining had its break through around 7000 years ago (Radivojević et al., 2010), and human kind started to leave the path of sustainability. During the Bronze Age, Au and Sn were also metallurgical extracted. Now, humanity started to use the natural geo-resources, water, soil, and metals.

The use of iron starts about 6000 years ago, and is finally responsible by the combination of iron oxide and coal mining in the steel production to trigger the industrial revolution in the 18th Century (~1760–1840). Until the industrial revolution, mining was a critical aspect for the technological development. But due to the fact that mainly local high ore grade enrichments of specific elements were exploited from local, and mainly oxide ores, the environmental impact was limited. Although, Agricola in 1556 mentioned yet the first environmental impact of mining. The benefit of the technological developments was only accessible to a limited number of members in the high society, while the grand majority of the human population still was living in a classical agricultural setting. During the industrial revolution, people started then to migrate from the country side towards the industrial centers, resulting in the first industrial urbanizations.

_

The change from oxide ore to sulfide ore extraction, which is related to the invention and the first industrial applications of the flotation technique in the late 19th and early 20th century (Fuerstenau et al., 2007), marks a critical change in the development of supply and use of metals in modern human society. Flotation separates valuable minerals from waste rock (gangue) by exploiting differences in their wettability, using air bubbles to selectively float hydrophobic particles to the surface. This new technique made low ore-grade sulfide deposits economically profitable. This made the metals cheaper and available for a broader use in technical application, from which the wide mass of humans could take advantage through the industrialization process. Until today, the very same approach is applied in mineral processing. Recovery improvements were achieved by diminution of the grain size during the comminution process.

Flotation enabled the exploitation of low ore grade sulfidic deposits (e.g. porphyry copper), to supply the increasing demand of copper due to the increasing electrification during the early 20th century. These deposit types (e.g. Chuquicamata, Chile, Bingham, USA), which contain only about 0.2–2.5% wt% Cu, result in the production of enormous amounts of waste material (96–99%) in form of so-called waste-rock dumps (Bao et al., 2020; Smuda et al., 2007) and tailings impoundments (Smuda et al., 2014). These waste materials represent a threat to the nearby society, as acid mine drainage (AMD) (Dold, 2014), dust, and tailings dam failures threaten closely living populations.

_

With the invention of computers, development of the Internet, Smart Phones, and many other smart high-tech gadgets in the last 30 years, demands for metals and new demands for elements like REE’s, PGE’s exploded, making their supply critical for industrial and economic development (EU, 2017). Additionally, with the change from fossil energy towards renewable energy matrices around the globe together with the electrification of the transport infrastructure, new resources for battery production, the so-called battery elements Co, Ni, Li, Mn, with new and mostly unknown environmental challenges are needed to be explored and exploited. This represents the latest step in the development of raw material demand and mining processes.

_

A fundamental principle of sustainable economic development and smooth manufacturing cycle, particularly in well-established economies, is the uninterrupted supply chain with raw materials that is free from disturbances and bottlenecks, contributing to the pricing instability and market volatility, thus disrupting the production. This condition is valid for a variety of technologies since raw materials play an important role in defense, the economy, renewable energy development and infrastructure. Growing reliance on raw materials has intensified the competition to identify new resources and establish stable, long-term supply chains. Although the increasing interest in minerals resources, caused by global competition, reached such enormous attention in recent years, the subject is not new and has been considered for decades. The minerals awareness was initiated after World War I as a warranty of sustaining military power. The term “strategic and critical minerals” was used as early as 1938 when emphasizing that the industrial nations should be self-sufficient in regard to certain materials, portrayed as the “materials essential in the promotion of modern warfare”. Similar terminology was used in the “Strategic and Critical Materials Stock Piling Act” of 1939, when political conflicts dominated concerns about the security of raw materials supplies. At present, in the USA and Canada the term “critical minerals” is used while “critical raw materials” (CRM) is used by the European Union. The other terminology includes “strategic minerals” or “advantageous minerals” used by China.

_

Critical minerals (rare earths, platinum group elements, nickel, zinc, etc.) are essential for high-technology products (Ballinger et al., 2019), but the market often overlooks their importance. These minerals exist primarily in co-associated forms, and the current small scale of their market means they are often sold as a by-product from other bulk mineral extraction. Critical minerals are often hidden in indirect and embedded trade, leading to the analysis of their reserves being neglected in assessing minerals production and import/export trade (Fortier et al., 2019). The supply of critical minerals and their products’ environmental and social impacts are also often overlooked in assessing the transition of fossil energy economies.

As the global political response to climate change accelerates and clean energy and transportation technologies advance, net-zero goals are becoming technically, economically, and politically feasible (Burger et al., 2022; Boire and Nell, 2021). Countries are putting forward their carbon-neutral roadmaps and investing heavily in emissions reduction. Clean energy and transportation systems are seen as central to future national competitiveness. Critical minerals are needed for this technological shift to meet the goal of net-zero (Gielen and Lyons, 2022). For example, a typical electric car requires six times the mineral input of a conventional vehicle, and an onshore wind power plant requires nine times the mineral resources of a natural gas plant (Kirsten et al., 2020). According to the International Energy Agency (IEA), “the average amount of minerals required for a new power unit has increased by 50 % since 2010, as the share of renewables in new investment has risen” (IEA, 2021). In carbon emission reductions alone, the World Bank estimates that about 3 billion tons of critical minerals will be needed to decarbonize the global energy system by 2050 (Prassl, 2020), with the production of minerals such as graphite, lithium, and cobalt needed to increase by nearly 500% by 2050 to meet the need for clean energy. Meeting the demand for critical minerals on such an enormous scale will require changes to the existing order of production and trade regulation of critical minerals. In contrast to the strong demand for these minerals, their supply is highly inelastic and fragile. Many deposits are in developing and highly underdeveloped countries, where mining has historically had challenges with corruption, pollution, human rights, and violence. Mineral extraction, therefore, often becomes a catalyst for negative community impacts (Sovacool, 2019).

_

Engineered application of some chemical elements of metals, non-metals and minerals into high-tech products have made our modern lives much easier than ever before. These chemical elements include REEs (e.g., cerium, lanthanum, neodymium, dysprosium, praseodymium, scandium, erbium, europium, terbium and yttrium), precious metals (e.g., rhodium, palladium, and platinum), radioactive metals (e.g., uranium and radium) and alkaline metals (e.g., magnesium, potassium, and Li). Their applications are widespread in high-tech industries which are critical to modern society and sustainable development. Such industries include telecommunications, renewable energy, electric vehicles, aerospace, medical, agriculture and defense technologies. Moreover, the uses of these minerals in these industries are expected to grow significantly in the coming decades. This is likely due to increasing population with increasing standards of living for the vast majority of the world’s population, and meeting the targets of the low-carbon society to contain the impacts of climate change. For example, the demand for Li, Co, manganese (Mn) and aluminum (Al) is expected to be increased by 12 times in 2050 compared to 2013. However, the supply of these minerals may be at risk due to various reasons including geological scarcity, geopolitical issues and trade policies. The geopolitical and trade policies pose the greatest threat to the supply disruptions of these minerals as their production is concentrated only in few countries. For example, the production of REEs, Co and Li are concentrated mainly in China (59%), the Democratic Republic of Congo (DRC) (68%) and Australia (49%), respectively. Furthermore, for most of the critical minerals, there are no true substitutes, meaning that the consumers, economies and deployment of low-carbon technologies could be significantly affected if they are subject to supply restrictions. Due to the perceived unreliable supply of these minerals against their multi-sectoral importance, they are known as critical elements or critical raw materials (CRM) or critical minerals in many of the world’s largest economies such as the United States of America (USA), European Union (EU) including United Kingdom (UK), and Australia.

In many cases, critical elements are geologically dispersed (Henckens et al., 2016), concentrated in a few geographic locations (Gloser et al., 2015), or recovered as a byproduct of another commodity (Redlinger and Eggert, 2016; Nassar et al., 2015). Critical element supply might benefit from additional research or proactive policies, such as improved mineral processing, diversifying the supply chain, and stockpiling (Jaffe et al., 2011). Further research would also help determine which critical elements would benefit from market transformation and improved economic opportunities (Sykes et al., 2016).

_

Critical minerals (CMs) are metals and non-metals that are considered vital for the economic well-being of the world’s major and emerging e-economies. Yet their supply may be at risk due to geological scarcity, geopolitical issues, trade policy and other factors. CMs ranked as most critical for the world’s major industrial economies (plus their use in futuristic developments in energy, health, construction and transportation sectors as well as in space, nuclear, defence and artificial intelligence) of USA, Japan, Republic of Korea, European Union and the UK include rare earth elements (REEs), platinum group metals (PGMs), lithium (Li), beryllium (Be), gallium (Ga), germanium (Ge), indium (In), tungsten (W), cobalt (Co), niobium–tantalum (Nb–Ta), molybdenum (Mo), antimony (Sb), vanadium (V), nickel (Ni), tellurium (Te), chromium (Cr), tin (Sn), thorium–uranium (Th–U), zirconium (Zr), hafnium (Hf), selenium (Se), rhenium (Re), phosphate, potash, etc. From the perspective of each country, the list of CMs may change. The CMs occur in three major sources: primary – in different minerals/ores that are extracted from the earth; secondary – in waste materials such as e-waste, and tertiary – in imports.

_

Key points:

- Geographical Distribution of Critical Minerals: Found unevenly across regions; key reserves in Africa (cobalt), Australia (lithium), China (rare earths), and South America (Lithium Triangle).

- Mining and Extraction of Critical Minerals: Methods include open-pit mining, underground mining, and in-situ leaching; each poses environmental challenges.

- Economic Importance of Critical Minerals: Crucial for electronics, batteries, and renewable energy systems, influencing global trade and economic stability.

- Global Supply Chain of Critical Minerals: Involves mining, processing, manufacturing, and distribution; influenced by logistical, geopolitical, and environmental challenges.

- Critical Minerals in Sustainable Development: Essential for technologies like EV batteries and solar panels, highlighting the need for sustainable management and sourcing.

______

______

Definitions of critical minerals:

Critical minerals refer to mineral resources, both primary and processed, which are essential inputs in the production process of an economy, and whose supplies are likely to be disrupted on account of non-availability or risks of unaffordable price spikes. These minerals lack substitutability and recycling processes. The global concentration of extraction and processing activities, the governance regimes, and environmental footprints in resource abundant countries adversely impact availability risks. While some of these minerals are inputs for traditional industries, many are crucial for the high-tech products required for clean energy, national defence, informational technology, aviation, and space research (Chadha, 2020).

______

Modern economies rely on countless raw materials. Many minerals have important uses but, by dint of plentiful supply, functioning markets or an ability to substitute them, do not warrant the focus that others may at this stage. By necessity of focus, only some are defined as “critical”.

These ‘critical minerals’ are not only vitally important but are also experiencing major risks to their security of supply. These risks can be caused by combinations of factors including but not limited to rapid demand growth, high concentration of supply chains in particularly countries, or high levels of price volatility. Many of these critical minerals are produced in comparatively small volumes or as companion metals (meaning they’re produced as by-products of other mining activities), are non-substitutable in their applications and have low recycling rates.

Figure below shows that Critical minerals are a subset of all important minerals.

______

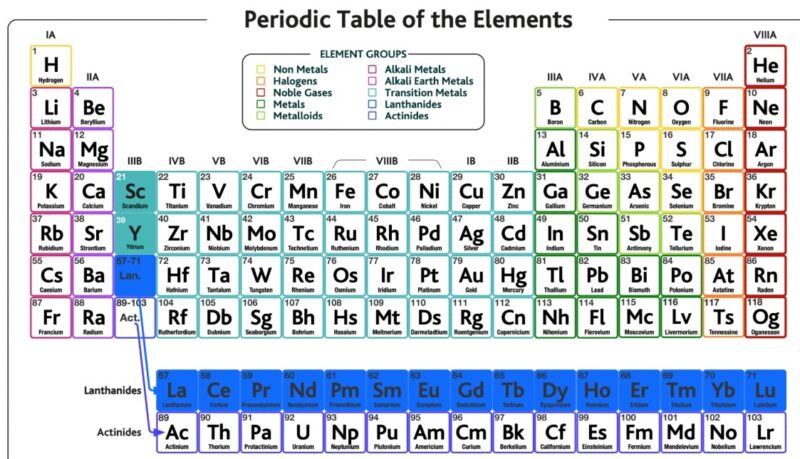

Rare earth elements (REEs) are a subset of critical minerals and materials. Figure below shows Critical Minerals including Rare Earth Elements in periodic table.

_____

Defining Minerals Criticality:

Minerals criticality is a subjective concept that has been shaped throughout decades. A number of criticality studies were conducted in an effort to define a consensus of currently critical materials, essentially defining the modern criticality paradigm, which allows the interpretation of local perspectives in a global context. The supplies of critical minerals are recognized to be a subject of great societal and environmental risk and uncertainty. It should be emphasized that the scarcity of a mineral in the Earth’s crust alone does not automatically make it critical. A classification of the mineral as critical is derived through its importance to key industry sectors or applications and the overall functioning of the country economy. The criticality criteria may vary across geographical regions, though the essence remains similar. Material criticality is defined as “economic and technical dependency on a certain material, as well as the probability of supply disruptions, for a defined stakeholder group within a certain time frame”.

_

According to the IEA, the classification of materials as critical is based on:

- Their significant economic importance for key sectors in the regional economy and/or national security;

- A high-supply risk due to the very high import dependence and high level of concentration of a set of critical raw materials in particular countries;

- A lack of viable substitutes, due to the very unique and reliable properties of these materials for existing, as well as future applications.

_____

Critical minerals are defined in the Energy Act of 2020. According to the Act, minerals are considered “critical” if they fit three criteria:

-1. The mineral must be “essential to the economic or national security of the United States.”

-2. The mineral must “serve an essential function in the manufacturing of a product… the absence of which would have significant consequences for the economic or national security of the United States”

-3. The mineral must have a supply chain that is “vulnerable to disruption (including restrictions associated with foreign political risk, abrupt demand growth, military conflict, violent unrest, anti-competitive or protectionist behaviors, and other risks through-out the supply chain)”.

In addition, the Act specifies that the “critical minerals’ cannot include fuel minerals such as oil, gas, coal or uranium. Water, ice, snow or “common varieties of sand, gravel, stone, pumice, cinders and clay” are also excluded from being critical minerals.

Geoscience Australia refers to critical minerals as “metals, non-metals and minerals that are considered vital for the economic well-being of the world’s major and emerging economies, yet whose supply may be at risk due to geological scarcity, geopolitical issues, trade policy or other factors”.

_____

The European Union (EU) defines them as critical raw materials (CRMs) that have “high importance to the economy of the EU and whose supply is associated with high risk”. The criticality is judged by two main parameters, economic importance and supply risk.

Factors affecting Criticality are addressed in figure below:

The importance of a metal is evaluated based on:

(i) its end-use applications; and

(ii) its substitutability (index) which, in the context of importance, is a measure of the cost and performance of substitute material in these applications.

The supply risk for a metal is evaluated based on its:

(i) Substitutability (index), which, in the context of supply risk, is the measure of the production and criticality of the substitute metal;

(ii) End-of-life recycling rates (EOL-RR), which is the proportion of metal produced from EOL scrap and other low-grade residues; and

(iii) Global supply, which is affected by factors such as the number of producing countries, trade agreements and supply chain bottlenecks (European Commission, 2017).

Consequently, the degree to which a metal, mineral or material is considered critical, is determined by geopolitical factors that change with time (Spooren et al., 2020). For example, Australia has 24 “critical minerals” (Austrade, 2020) compared to the EU’s 30 “critical raw materials” (European Commission, 2020). The EU has also seen an increase in the number of raw materials being deemed critical over time. In 2011, 2014 and 2017, there were 14, 20 and 27 raw materials deemed critical, respectively, compared to the 30 in 2020 (European Commission, 2020). It is likely that the number of metals (as well as minerals and materials) considered critical will continue to fluctuate over time, highlighting the need for regular assessments of metal criticality.

_

The concentration of critical metals in the Earth’s crust is variable. For example, vanadium occurs at an average crustal abundance of 138 ppm whereas indium’s abundance is 0.052 ppm (Rudnick and Gao, 2014). Mineralogically, critical metals either occur as structural components of minerals, as substitutions within other minerals and ores, or in some cases as native elements (e.g. rhenium, tellurium; John et al., 2017; Goldfarb et al., 2017). In many instances, minerals formed with critical metals as a structural component do not occur in sufficient concentrations to make their extraction economical. An example of this is indium – while there are 12 defined indium minerals, the occurrence of these minerals is rare (Schwarz-Schampera, 2014). Conversely, economic concentrations of critical metals regularly occur in minerals where they have substituted for a chemically similar base metal. For example, rhenium is principally hosted in molybdenite [MoS2], with rhenium substituting for molybdenum, and the concentration of rhenium in molybdenite can be up to several weight percent (John et al., 2017). This association is also reflected in many of the principal deposit types for critical metals. For example, cobalt shares chemical similarities with copper and nickel, and is often found in magmatic sulphide and stratiform sediment-hosted deposits endowed with these metals (Dehaine et al., 2021). Consequently, critical minerals are often produced as a by-product of major commodity mining. For example, indium, germanium and gallium are typical by-products of zinc refinement (Werner et al., 2017; Ruiz et al., 2018; Foley et al., 2017). Significant concentrations of critical metals have also reported to mining wastes over time due to processing infrastructure being unsuitable for extraction of the substituted critical mineral. For example, Werner et al. (2017) estimated that a minimum of 24 kt of indium is present in mining wastes globally. Unfavourable economics, inefficient processing and mineralogical factors may also have resulted in critical metals reporting to mining wastes over time (Lottermoser, 2010).

_

With a movement towards low-carbon economies, demand for critical metals is set to expand worldwide over the coming decades. For example, cobalt and nickel are incorporated in batteries used in electric and hybrid-electric vehicles (Slack et al., 2017), and germanium substrates are used to form the base layer in multijunction solar cells (Shanks et al., 2017). Concurrently, there is a drive to transform the mining industry into a circular economy system, requiring transformation of mining and processing wastes into valuable products. Processing of mining wastes rich in critical metals both aids in meeting this demand and aligns with achieving a circular economy mining system. However, to extract these minerals, processing technologies need to be developed or adapted to mining wastes, which have different properties (e.g. particle sizes, poor mineral liberation) compared to run of mine ores and concentrates.

______

THE CRITICALITY MATRIX:

The two important dimensions of criticality are importance in use and availability. Importance in use embodies the idea that some nonfuel minerals or materials are more important in use than others. Substitution is the key concept here. For example, if substitution of one mineral for another in a product is easy technically, or relatively inexpensive, one can say that its importance is low. In this case, the cost or impact of a restriction in the supply of the mineral would be low. On the other hand, if substitution is technically difficult or is very costly, the importance of the mineral is high, as would be the cost or impact of a restriction in its supply. This concept of importance at a product level significantly includes the net benefits customers receive from using a product—the benefits to human health of nutritional supplements or pollution control equipment, the convenience of cell phones, the durability of an automobile, and so on.

_

A nonfuel mineral can be important at a scale larger than a product as well as at the product level. A mineral might be important to the commercial success of a company and the company’s profitability (importance at a company level). A mineral might be important in military equipment and national defense. Production of a mineral—or products that use the mineral as an input—might be an important source of employment or income for a local community, a state, or the national economy (importance at a community, state, or national level). In all of these cases, the greater the cost or impact of a restriction in supply, which depends importantly on the substitutability of the mineral in question, the more important is the mineral.

_

Availability is the second dimension of criticality. Fundamentally, society obtains all nonfuel minerals through a process of mining and mineral processing (primary supply). Later, however, in the course of fabrication and manufacturing—and ultimately after products reach the end of their useful lives—society can obtain mineral products through the processing of scrap material (secondary supply). Availability reflects a number of medium- to long-term considerations: geologic (does the mineral exist?), technical (do we know how to extract and process it?), environmental and social (can we extract and process it with a level of environmental damage that society considers acceptable and with effects on local communities and regions that society considers appropriate?), political (how do policies affect its availability both positively and negatively?), and economic (can we produce a mineral or mineral product at costs consumers are willing and able to pay?). In addition, it is important to consider the reliability or risk of supply in the short term. Is the nation vulnerable to unexpected disruptions in availability due to, for example, import dependence, market power in the hands of a small number of powerful producers, thin or small markets that are unable to respond quickly to changing circumstances, or significant changes in public policy that cut off supply or increase costs?

_

In both dimensions of criticality, time is an important consideration. In the short term (period of a few years or less) or the medium term (less than 10 years), both mineral users and producers generally are less able to respond quickly or effectively to changing market conditions than over longer time periods. Even within a particular period, however, some minerals will be more important in use and more vulnerable to supply disruptions than other minerals. For a given adjustment period (short term to long term), the critical minerals are those that are relatively difficult to substitute and are subject to supply risks.

_

Figure below illustrates concept of criticality and the criticality matrix.

The vertical axis embodies the idea of importance in use and represents the impact of supply restriction. The horizontal axis embodies the concept of availability and represents supply risk. One can evaluate a mineral’s criticality by evaluating its importance in use and its availability, and locating it on the figure. The degree of criticality increases as we move away from the figure’s origin, as shown by the arrow and the increased shading. The degree of criticality increases as one moves from the lower-left to the upper-right corner of the figure. In this example, mineral A is more critical than mineral B. In this sense, criticality is appropriately considered a “more-or-less” issue rather than an “either-or” issue. That is, minerals exhibit differing degrees of criticality depending on the circumstances. Some minerals are more critical than others; it is a matter of degree rather than absolutes. To be sure, some mineral users or government officials may want to create a list of critical minerals, implying that minerals not on the list are not critical, for purposes of planning or policy making.

_

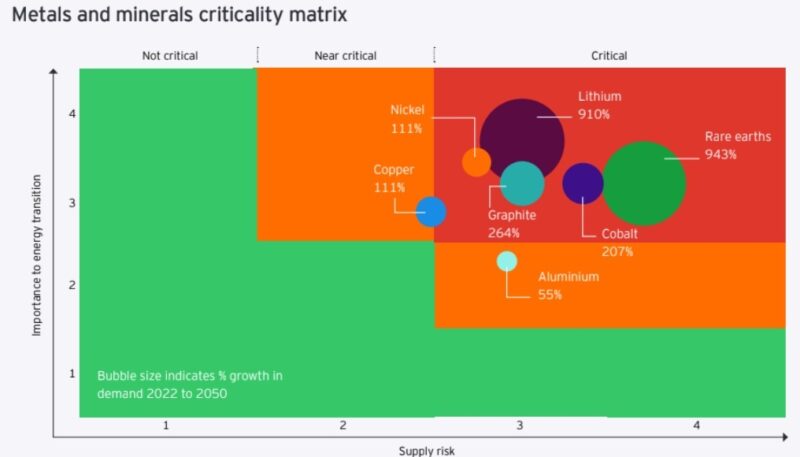

The energy transition has an insatiable appetite for critical minerals. And it’s an appetite that’s only growing; between now and 2050, demand for the minerals and metals most key to decarbonization is projected to skyrocket. According to a report released recently by Ernst & Young, demand for graphite and cobalt is set to increase by well over 200%; demand for lithium, by 910%; and for rare earths, by 943% as seen in figure below.

The good news for clean tech is that there’s likely enough to go around; the earth’s crust has no shortage of the critical minerals to power the energy transition. However, both exploration and processing are highly geographically concentrated, primarily in China. Plus, finding critical minerals (including discovering new ones) is very difficult, and very expensive.

_

Materials Criticality Matrix, Medium Term (2025-2035) is depicted in figure below.

_____

Criticality perspective among nations:

To help determine criticality, two perspectives can be considered:

-1. Security and Control of Supply

Minerals are considered critical when they are of high economic importance but are scarce and therefore subject to high import dependency. A key element in this definition is the vulnerability of the supply chain due to risks associated with potential supply disruptions, governance issues, political risks, or the overconcentration of production in a few countries. This definition is largely adopted by European countries, the United States, and Japan, for instance.

-2. Value Capture

Minerals are also considered critical when they are present in abundance, and the country has a strategic interest in using its dominant position to gain competitive advantage in the global supply chain. Countries using this lens to define criticality are Canada, Australia, and China. This lens is also relevant for countries with substantial reserves of minerals and metals needed for the low-carbon transition, such as Indonesia (nickel, bauxite), Gabon (copper, manganese), Mozambique (graphite, bauxite), Namibia (rare earth elements, tantalum), Nigeria (manganese, lithium), Bolivia (lithium, gallium), and Kazakhstan (copper-lead-zinc).

_

Figure below shows criticality perspective among nations:

* Indicative assessment based on a compilation of country statements (e.g., Executive Order, Mineral Strategy), recent data on production, reserves and discoveries (e.g., copper in Peru, chromium in Sudan), and international reports and publications (e.g., IEA Country Reports).

_______

There are also factors that can influence or inform what criticality means to individual countries and/or regions, and these factors can be determined by considering criticality from the following five dimensions:

-1. ECONOMIC

- Economic security

- Strategic or competitive advantage

- Industrial development objectives

- Social development goals

- Infrastructure development needs

-2. SUPPLY CHAIN

- Supply risks and vulnerability

- Import dependency

- Geographic concentration of production and processing (refinery)

- Viability of substitutes and availability of secondary sources • Value chain opportunities

-3. TECHNOLOGY

- Essential input to clean technologies

- Required for low-carbon transition

- Technological innovations and emerging mineral substitutes

-4. GEOPOLITICAL

- National security considerations

- Risks of resource nationalism and stockpiling

- External shocks and geopolitical realignments

-5. GEOLOGICAL

- Natural resources endowment

- Availability of reserves and production capacity

- Location and quality of ores, metal or mineral content, and depletion rates

______

______

Critical minerals: A review of elemental trends in comprehensive criticality studies, 2018:

Mineral criticality is a subjective concept that has evolved throughout history. An abundance of literature on this topic has been published over the last decade, encompassing a variety of criteria and methodologies. To authors knowledge, this work is the first large-scale effort to organize and analyze recent comprehensive criticality studies in order to determine if a consensus exists within the global community as to which elements are critical. Here, authors set aside methodological differences and analyze the results of 32 comprehensive nonfuel mineral criticality studies that evaluate at least 10 elements. Of the 56 elements or elemental groups evaluated, the three most commonly identified as critical in these studies are the rare-earth elements (REE), the platinum-group metals (PGM), and indium. Most of the studies also identify tungsten, germanium, cobalt, niobium, tantalum, gallium, and antimony as critical.

______

______

Core mineral versus Critical mineral:

The term “critical minerals” has become so broad that it risks losing its meaning. Virtually every metal essential to modern industry is now labeled critical, diluting the term’s significance. However, a clear distinction must be made between minerals that are vital yet accessible and those that pose a serious supply risk due to lack of domestic reserves, dependence on geopolitical adversaries, or absence of control over processing capabilities.

Core minerals are those that are essential but remain accessible through normal market mechanisms, without requiring government intervention. The distinction is crucial because it determines whether policymakers can rely on free market forces or must adopt state-led strategies to secure supplies.

It also was clear at Mining Indaba 2025 conference in Cape Town that what is critical to one country isn’t necessarily of much importance to another. This means that a critical mineral is one that you need, but you don’t have domestic reserves, your strong allies also don’t have sufficient deposits and you don’t control enough of the supply chain to ensure you get what you need when you need it. A mineral in this situation is distinct from what commodity analysts refer to as a core mineral, which is one that you need but you are fairly confident that you will be able to source now and in the future.

Why is this distinction important?

From a Western perspective, a core mineral is one that you largely can leave to market forces to supply, relying on private mining companies to explore, develop and produce on commercial terms.

However, a genuinely critical mineral is likely to require a different strategy to acquire, such as directly funding new mines, building strategic relationships with host countries and offering offtake agreements that aren’t dependent on market prices.

China has proven much more adept at targeting minerals it sees as critical, investing in mines and infrastructure in foreign countries and in processing plants at home, thereby locking in control of the supply chain.

This has seen China, the world’s biggest importer of commodities, come to dominate much of the global supply chain for minerals vital to the energy transition, such as lithium, cobalt, nickel and rare earths.

The British Geological Survey assesses that there are 18 minerals that have high potential criticality for the UK. China has the leading market share in the 12 listed in the figure below in 2023.

_______

_______

Two major drivers:

Critical minerals are minerals and metals that play an actual or potentially important role in countries’ economies. They are indispensable for industrial processes and essential to manufacturing sectors but are vulnerable to supply chain disruptions due to factors such as geographic concentration, political instability, or market volatility (Ramdoo et al., 2024).

Two largely interrelated movements are fuelling the rush for critical minerals worldwide.

The first is the transition toward low-carbon and decarbonized energy systems, which has ignited a surge in exploration for and production of the “battery minerals” (graphite, cobalt, nickel, and lithium, among others) needed to power low greenhouse gas (GHG) emissions technologies. In its Sixth Assessment Report (AR6), the Intergovernmental Panel on Climate Change (IPCC) warns that under high GHG emissions scenarios, global temperatures could surpass 2ºC above pre-industrial levels by mid-century (IPCC, 2023). Achieving net-zero emissions will require transformative technological changes, which offer the most viable pathway to mitigating warming and limiting severe climate impacts.

The second movement is the transition to the digital economy. Technologies that fall into the category of “digital industry” include big data analysis, machine learning, industrial Internet of Things, augmented reality, 3D printing, and robotics (Hushko et al., 2021). The tangible impact of digital technologies—the metals and resources essential to their production—becomes clear when one considers, for example, the demand for wireless technology and computing alone. The digital economy even extends to the extraction of the very minerals being coveted, as a number of large-scale mines are becoming increasingly automated (Ramdoo et al., 2024).

_

These two major drivers occur while the demand for societal needs, industrialization, and development stays high. The most conservative forecasts indicate that enormous supplies of critical minerals will be required to satisfy the projected demand over the next 3 decades (International Energy Agency [IEA], 2022b). Significant attention has been paid to battery minerals because of their use in energy storage and electric vehicle (EV) technologies. The Sustainable Development Scenario developed by the IEA in line with the Paris Agreement

(climate stabilization below 2°C global temperature rise, aiming to reach net-zero globally by 2050) suggests that global demand in 2040 compared to 2021 could grow 40 times for lithium and between 20 and 25 times for nickel, cobalt, and graphite (Fu et al., 2020; Hailes, 2022; IEA, 2022ba; Ritoe et al., 2022). In Europe alone, to meet the escalating demand for EV batteries and energy storage, the supply chain will require securing 18 times more lithium by 2030 and up to 60 times more cobalt by 2050 compared to 2020 (Bobba et al., 2020).

_

The development of critical mineral lists by an increasing number of countries has driven the demand upward, putting significant pressure on traditional producers of certain commodities: the Democratic Republic of the Congo (DRC) for cobalt; Madagascar, Mozambique, and China for graphite; Chile, Bolivia, and Argentina for lithium; Indonesia and the Philippines for nickel; China and Indonesia for tin; and Chile, the DRC, Peru, and Zambia for copper (U.S. Geological Survey, 2023). To meet this demand, governments and industries have led efforts to identify and explore new sources of critical minerals.

______

______

Critical Minerals vs. Critical Materials:

A lot of people often confuse these two terms with each other. It is worth remembering that while they are closely related, there are distinct differences between the two terms:

|

Category |

Critical Minerals |

Critical Materials |

|

Definition |

Naturally occurring minerals and elements essential for key industries |

Broad category including critical minerals, metals, and engineered materials crucial for industrial and technological uses |

|

Examples |

Lithium, cobalt, nickel, rare earth elements, graphite |

Rare earth magnets, semiconductors, advanced composites, battery materials |

|

Importance |

Essential for clean energy, defense, and high-tech industries |

Key for manufacturing, national security, and infrastructure |

|

Supply Chain Risks |

Often scarce, geopolitically controlled, or difficult to extract |

Can be resource-intensive, expensive, or require complex processing |

|

Applications |

Batteries, renewable energy, aerospace, electronics |

Military equipment, electric vehicles, medical devices, communication systems |

|

Policy Focus |

Mining, refining, recycling, and securing supply chains |

Research, innovation, sustainable sourcing, and material substitution |

Note:

The terms “critical mineral” and “critical minerals and materials” are often used interchangeably, referring to the same concept: essential minerals that are vital for economic and national security. The distinction is subtle, with “critical minerals” typically focusing on the raw mineral substance, while “critical minerals and materials” additionally include processed or refined forms of those minerals.

_____

Primary vs secondary mineral: