Dr Rajiv Desai

An Educational Blog

DIGITAL TRANSACTION

Digital transaction:

___

____

Prologue:

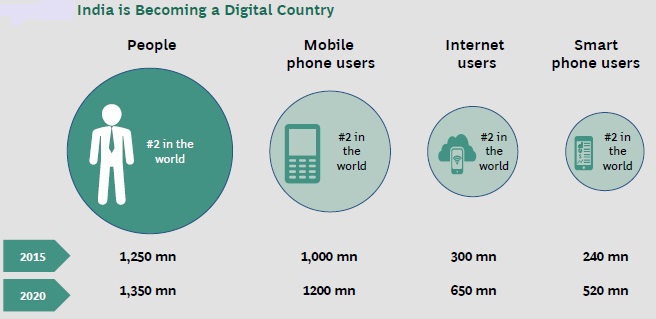

History of banking dates back to 2000 B.C. Archaeologists believe that depositing and lending have always been human way of business and economy during renowned Roman, Chinese, and Indian empires. In fact, if we really think about it, there can actually be no trusted way of keeping earned money safe to be used when required other than a trusted group that also provides interest on such deposits. From that time banks and their ways have evolved tremendously. Computing revolution has been the biggest step forward here. For what was confined to signatures and psychical presence, has now been replaced by plastic money and virtual presence. John Shepherd-Barron, the Scotsman is credited with inventing the world’s first automated cash machine. Shepherd-Barron said once that he came up with the idea of the cash machines after being locked out of his bank. Plastic bank cards had not been invented yet, so Shepherd-Barron’s machine used special checks that were matched with a personal identification number. The first automated teller machine (ATM) was installed at a bank in London in 1967. The history of economic development has been characterised by periods of massive transformation brought about by technological innovation. Steam power led to industrialisation and rapid urbanisation, electricity enabled the assembly line and mass production of consumer goods, the automobile encouraged mass mobility and the development of suburban living, and the internet and World Wide Web have revolutionised access to communications and knowledge. Digital money is a technology that moves economic transactions, payments, remittances and transfers from the physical into the digital world. Many people today are using a mix of cash and online methods of payment. People are increasingly paying their bills through banks and using credit/debit cards and other online transactions. The old adage that “criminals go where the money is” finds aptness today as criminals go where digital transaction occurs. Security is essential for any payment transaction that takes place over internet/private network. My website was hacked repeatedly for 2 days on 5th and 6th February 2017 discarding my previous article “Are ordinary people bad?” posted on 22/12/2016. If this can happen to an educational website where no monetary gain is achievable, what about digital transaction? So security of digital payment has to be of paramount importance and gets priority over other aspects of digital transactions. This article is delayed due hacking of my website and consequent measures to upgrade security.

_____

Abbreviations and synonyms:

ATM = automated teller machine

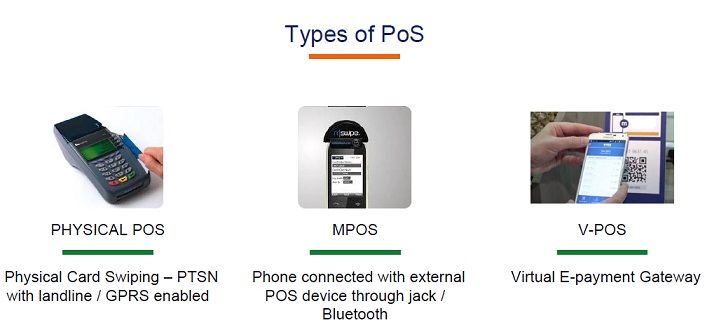

POS = point of sale device

Aadhaar = A 12-digit unique number which UIDAI issue for all residents in India.

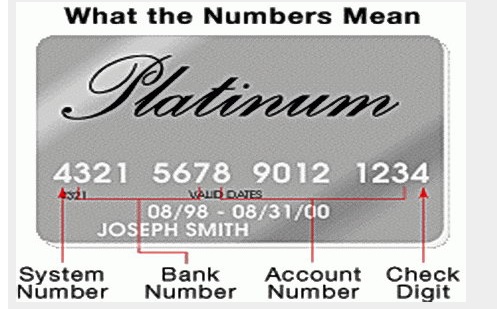

CSC = card security code = CVV = card verification value

NFC = Near Field Communication

BLE = Bluetooth Low Energy

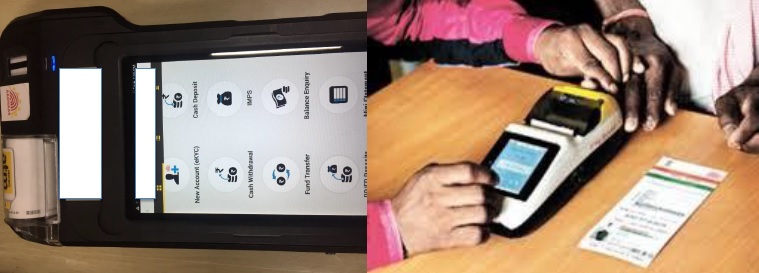

AEPS = aadhaar enabled payment system

USSD = Unstructured Supplementary Service Data

UPI = Unified Payment Interface

NCPI = national payment corporation of India

UIDAI = Unique Identification Authority of India

PIN = personal identification number

OTP = one-time password is a password that is generated for only one login session

EMV = Europay, MasterCard, and Visa [EMV card is chip card]

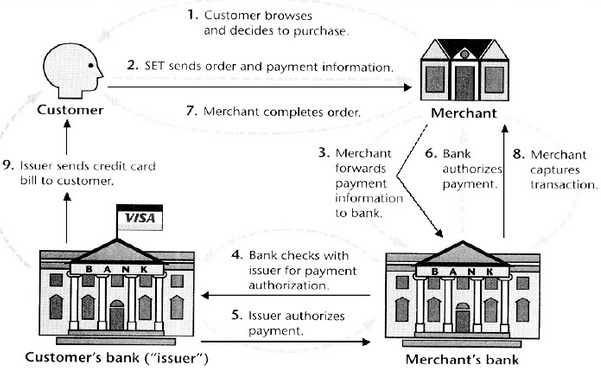

SET = Secure Electronic Transaction

RSA = Rivest, Shamir and Adleman [asymmetric cryptographic algorithm]

ECC = Elliptic curve cryptography

PAN = personal area network

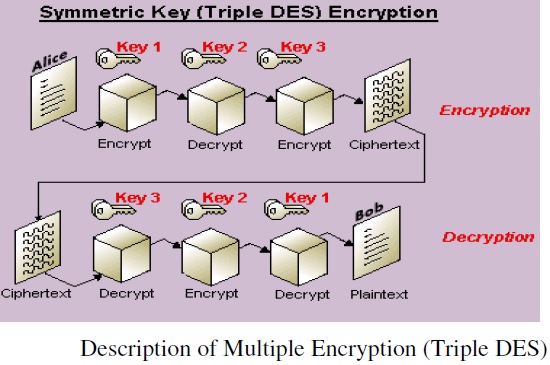

DES = Data Encryption Standard

AES = Advanced Encryption Standard

HTTPS = HyperText Transfer Protocol Secure

TLS = Transport Layer Security

SSL = secure socket layer

IVR = interactive voice response

RFID = Radio-Frequency Identification

HCE = Host card emulation

$ = US dollar = dollar

PSP = Payment service provider

P2P = peer to peer [peer-to-peer (P2P) network is created when two or more PCs are connected and share resources without going through a separate server computer]

____

Nomenclature used in this article:

Merchant: The term “Merchant” means any person who offers a Consumer goods and service and accepts orders directly from Consumers.

Consumer: The term “Consumer” means a customer, including a licensee, subscriber, or buyer, of any goods and service acting primarily in a personal, family, or household capacity – other than for purposes of resale.

Transaction: The term “Transaction” refers to any agreement for provision of a goods and service between a Merchant and Consumer.

Payer: Payer is a person or organization that gives someone money that is due for goods and services received or to be received or a debt incurred. Consumer is a payer.

Payee: Payee is the party in an exchange who receives payment. A payee is paid in cash, check (cheque), digital transaction or other transfer medium by a payer, with the payer receiving goods and services in return. Merchant is a payee.

Electronic: Electronic means relating to technology having electrical, digital, analog, magnetic, wireless, optical, electromagnetic, or similar capabilities.

______

Note:

Please read my articles ‘Computer and Internet’ at https://drrajivdesaimd.com/2010/01/23/the-computer-and-internet/ and ‘Smartphone’ at https://drrajivdesaimd.com/2015/02/09/smartphone/ to understand digital transaction better.

_____

_____

Basics of digital and analog:

Traditionally, digital means the use of numbers and the term comes from digit, or finger. Digit is a single character in a numbering system. In decimal system, digits are 0 through 9. In binary system, digits are 0 and 1. Computers are digital machines because at their most basic level they can distinguish between just two values, 0 and 1, or off and on. Today, digital is synonymous with computer. Digital information can assume only one of two possible values: one/zero, on/off. There is no simple way to represent all the values in between, such as 0.25. All data that a computer processes must be encoded digitally, as a series of zeroes and ones. The opposite of digital is analog. A typical analog device is a clock in which the hands move continuously around the dial. Such a clock is capable of indicating every possible time of day. In contrast, a digital clock is capable of representing only a finite number of times (every tenth of a second, for example). Analog information is made up of a continuum of values within a given range.

_

Digital describes electronic technology that generates, stores, and processes data in terms of two states: positive and non-positive. Positive is expressed or represented by the number 1 and non-positive by the number 0. Thus, data transmitted or stored with digital technology is expressed as a string of 0’s and 1’s. Each of these state digits is referred to as a bit (and a string of bits that a computer can address individually as a group is a byte). Prior to digital technology, electronic transmission was limited to analog technology, which conveys data as electronic signals of varying frequency or amplitude that are added to carrier waves of a given frequency. Broadcast and phone transmission has conventionally used analog technology.

_

If you have an analog watch, it tells the time with hands that sweep around a dial: the position of the hands is a measurement of the time. How much the hands move is directly related to what time it is. So if the hour hand sweeps across two segments of the dial, it’s showing that twice as much time has elapsed compared to if it had moved only one segment. That sounds incredibly obvious, but it’s much more subtle than it first seems. The point is that the hand’s movements over the dial are a way of representing passing time. It’s not the same thing as time itself: it’s a representation or an analogy of time. That’s really what the term analog means. Until computers started to dominate science and technology in the early decades of the 20th century, virtually every measuring instrument was analog. If you wanted to measure an electric current, you did it with a moving-coil meter that had a little pointer moving over a dial. The more the pointer moved up the dial, the higher the current in your circuit. The pointer was an analogy of the current. All kinds of other measuring devices worked in a similar way, from weighing machines and speedometers to sound-level meters and seismographs (earthquake-plotting machines). Digital is entirely different where every information (variable) is converted into numbers (digits) and displays or stores the numbers instead. Cell phones transmit and receive calls by converting the sounds of a person’s voice into numbers and then sending the numbers from one place to another in the form of radio waves. Used this way, digital technology has many advantages. It’s easier to store information in digital form and it generally takes up less room. You’ll need several shelves to store hundreds of analog LP records, but with an MP3 player you can put the same amount of music in your pocket! Electronic book (e-book) readers are similar: typically, they can store a couple of thousand books—around 50 shelves worth—in a space smaller than a single paperback! Digital information is generally more secure: cell phone conversations are encrypted before transmission—something easy to do when information is in numeric form to begin with. You can also edit and play about with digital information very easily. Anyone can edit a photo (in digital form) in a computer graphics program, which works by manipulating the numbers that represent the image rather than the image itself. It’s easy to convert analog information into digital: you do it every time you make a digital photo, record sound on your computer, or speak over a cell phone. The process is called analog-to-digital conversion (ADC). A modem is used to convert the digital information in your computer to analog signals for your phone line and to convert analog phone signals to digital information for your computer. Remember, most physical quantities are analog, thus a conversion is needed.

_

In general, humans experience the world analogically. Vision, for example, is an analog experience because we perceive infinitely smooth gradations of shapes and colors. Most analog events, however, can be simulated digitally. Photographs in newspapers, for instance, consist of an array of dots that are either black or white. From afar, the viewer does not see the dots (the digital form), but only lines and shading, which appear to be continuous. Although digital representations are approximations of analog events, they are useful because they are relatively easy to store and manipulate electronically. In analog technology, a wave is recorded or used in its original form. So, for example, in an analog tape recorder, a signal is taken straight from the microphone and laid onto tape. The wave from the microphone is an analog wave, and therefore the wave on the tape is analog as well. That wave on the tape can be read, amplified and sent to a speaker to produce the sound. In digital technology, the analog wave is sampled at some interval, and then turned into numbers that are stored in the digital device. On a CD, the sampling rate is 44,000 samples per second. So on a CD, there are 44,000 numbers stored per second of music. To hear the music, the numbers are turned into a voltage wave that approximates the original wave. The trick is in converting from analog to digital, and back again. This is the principle behind compact discs (CDs). The music itself exists in an analog form, as waves in the air, but these sounds are then translated into a digital form that is encoded onto the disk. When you play a compact disc, the CD player reads the digital data, translates it back into its original analog form, and sends it to the amplifier and eventually the speakers. When information, music, voice and video are turned into binary digital form, they can be electronically manipulated, preserved and regenerated perfectly at high speed. The millionth copy of a computer file is exactly the same as the original.

_

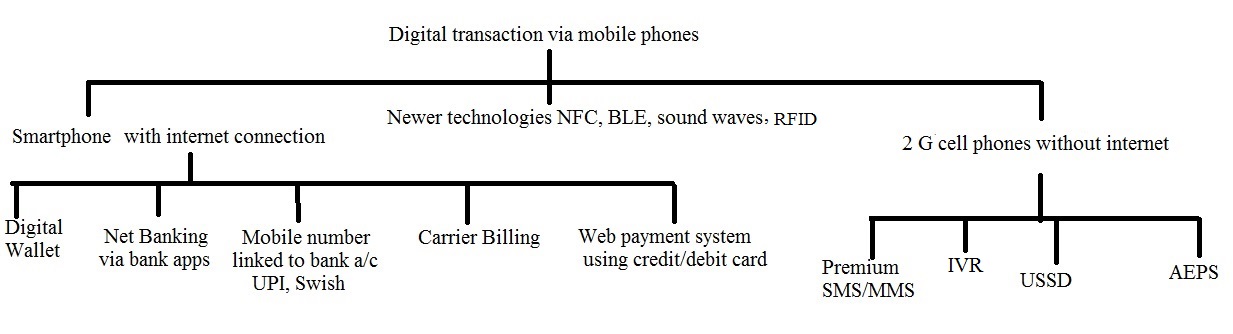

The above discussion presupposes that in order to carry out digital transaction, you ought to have computer/laptop or smartphone with internet connection. But you can carry out digital transaction without internet connection and even without phone provided you have intermediary that connect you to your bank. I want to emphasize that internet and digital are not synonymous. Non-internet digital transactions involve SMS, MMS, USSD, payment Processing IVR and AEPS through 2G mobile phones. For example, you may have 2G cell phone without any internet connectivity. You can still perform digital transaction through USSD code whereby your GSM telecom service provider can act as intermediary between you and your bank. You can even perform digital transaction without any phone provided your bank agent has micro-ATM which connects your ID (e.g. Aadhaar card in India) to your bank account. All these are digital transactions although you have neither internet connection nor phone. All ATM and POS transactions are digital transactions on private networks independent of internet although they may still use internet protocols. Internet means connecting a computer to any other computer anywhere in the world via dedicated routers and servers, digitally (data in the form of 0 and1). Internet is always digital but digital data can be transferred without using internet, for example using 2G cell phones with cellular networks and using ATM/POS with private interbank networks.

_________

_________

Money, cash and currency:

_

What is money?

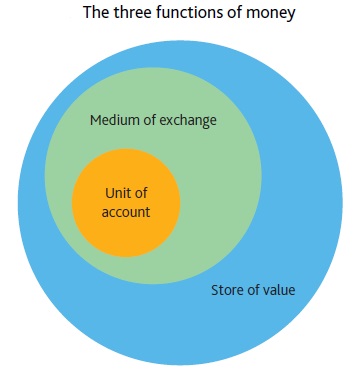

Throughout history there have been many different manifestations of money, both physical and electronic. Economists identify money through the roles that it serves in society. In particular, something may be considered money from the perspective of economic theory to the extent that it serves as a medium of exchange with which to make payments; a store of value with which to transfer ‘purchasing power’ (the ability to buy goods and services) from today to some future date; and a unit of account with which to measure the value of any particular item for sale.

_

Money is any clearly identifiable object of value that is generally accepted as payment for goods and services and repayment of debts within a market or which is legal tender within a country. The money can’t be in two places at once, can’t be double spent. In modern times the broader concept of “money” includes other forms of money such as bank accounts. Money as a means of exchange has been evolving way back. It is as old as man. We started from trade by barter and moved to coins and cowries and to paper money. In economics we are told that money is a store of value but the truth about it is that money stores value at the point of exchange, at the point of conversion of goods into money but as days go by the value is lost due to depreciation and devaluation. So, a lot of things affect money as we know it. Today, the present state of money is called fiat money. The thing about fiat money is that though it is a store of value, it fails to maintain that storage of value over a period of time. Every fiat money is subject to socio-political events, any negative socio-political events in a country affects value of stored money. Socio-political happenings affect the value of money; body language of the leaders of the country affects the money. So when a leader or top echelon of an administration makes a careless statement, it can affect the value of money. This aggregates into a substantial form over a period of time. This simply means that money in its present form does not provide a safe haven to store wealth, assets. Also, any money that does not have finite amount, that can be printed like fiat money cannot have a strong value, it does not provide a relative stability in storage of value.

_

Legal tender:

Legal tender is a medium of payment recognized by a legal system to be valid for meeting a financial obligation. Paper currency and coins are common forms of legal tender in many countries. Legal tender is variously defined in different jurisdictions. Formally, it is anything which when offered in payment extinguishes the debt. Thus, personal cheques, credit cards, and similar non-cash methods of payment are not usually legal tender. The law does not relieve the debt obligation until payment is tendered. Coins and banknotes are usually defined as legal tender.

_

Different measures of money supply:

Different measures of money supply include M0, M1, M2, M3 and M4. Not all of them are widely used and the exact classifications depend on the country. M0 and M1, also called narrow money, normally include coins and notes in circulation and other money equivalents that are easily convertible into cash. M2 includes M1 plus short-term time deposits in banks and 24-hour money market funds. M3 includes M2 plus longer-term time deposits and money market funds with more than 24-hour maturity. M4 includes M3 plus other deposits. The exact definitions of these measures depend on the country. The term broad money is used to describe M2, M3 or M4, depending on the local practice.

_

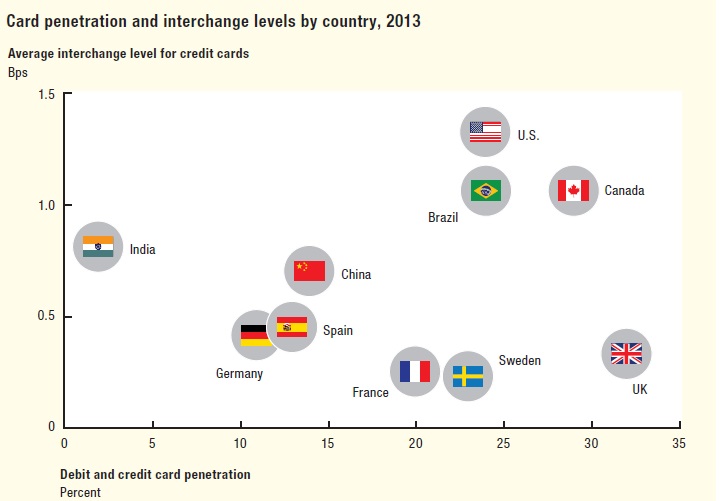

Cash is king in India:

Cash is money in the physical form of currency, such as banknotes and coins. The Indian payment business has been a high cash-intensive economy. To peak in the current scenario, the value of notes and coins in circulation in the economy as a percentage of GDP is ~12.2%, which is higher than countries like Russia (11.9%), Brazil (4.1%) and Mexico (5.7%). Another metric to compare cash intensity is to look at global monetary aggregates. M0 (amount of money held in bills and coins) relative to M2 (amount held in demand deposit and savings accounts) is a good indicator. For India, M0 as a percentage of M2 is over 50%, which is higher than other developing countries like Mexico (9%), South Africa (9%), or China (5%). Even in cash-intensive Egypt, M0 is 24% of M2. In addition, globally India had highest share of cash transactions among developed as well as developing countries; evident from the fact that nearly 87% of the value of all transactions in India in 2012, took place in cash. A few reasons for such high dependence on cash are factors including lack of means to use non-cash payments, existence of the black economy and lack of awareness, especially in rural India.

_____

_____

Transfer of money:

Money is believed to be first used in 600AD in China, and money transfers started about 150 years ago — around the time the telegraph was invented. Western Union completed the first transcontinental telegraph line in 1861. In 1879, WU left the telephone business. That inevitably led to money transfer becoming their primary business. In the past, transferring money was pricey, and it required lots of time and effort. One gave the money to a bank or a telegraph office, and the clerk would then send a note to the recipient, informing him to pay a specified amount. Finally, the bank or the telegraph office would send the money to adjust the imbalance in the other agency. Now, the process is similar — you go to a financial institution, and tell them to send the money to another place. The difference now is that over time, the transfer method has evolved to purely electronic, and it’s not as expensive. The main benefits of the electronic procedure are time-efficiency—completed for minutes, and safety—due to the money being tracked via an identification number. In recent years, many international money transfer companies have gone online, which has simplified the process and made it extremely popular–thus lowering the fees. You can now transfer money either through banks, or through money transfer company. Banks are always a solid solution for making payments abroad. While being trustworthy, banks tend to also have cluttered interdependent procedures, often resulting in slower service.

______

Cheque:

A cheque (or check in American English) is a document that orders a bank to pay a specific amount of money from a person’s account to the person in whose name the cheque has been issued. The person writing the cheque, the drawer, has a transaction banking account where their money is held. The drawer writes the various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay that person or company the amount of money stated. A cheque is a negotiable instrument instructing a financial institution to pay a specific amount of a specific currency from a specified transactional account held in the drawer’s name with that institution. Both the drawer and payee may be natural persons or legal entities. Cheques are order instruments, and are not in general payable simply to the bearer as bearer instruments are, but must be paid to the payee. In some countries, such as the US, the payee may endorse the cheque, allowing them to specify a third party to whom it should be paid. Cheques have been a tempting target for criminals to steal money or goods from the drawer, payee or the banks. A number of measures have been introduced to combat fraud over the years. These range from things like writing a cheque so it is difficult to alter after it is drawn, to mechanisms like crossing a cheque so that it can only be paid into another bank’s account providing some traceability. However, the inherent security weaknesses of cheques as a payment method, such as having only the signature as the main authentication method and not knowing if funds will be received until the clearing cycle to complete, have made them vulnerable to a number of different types of fraud.

_

Cheque usage has been declining for some years, both for point of sale transactions (for which credit cards and debit cards are increasingly preferred) and for third party payments (for example, bill payments), where the decline has been accelerated by the emergence of telephone banking and online banking. Being paper-based, cheques are costly for banks to process in comparison to electronic payments, so banks in many countries now discourage the use of cheques, either by charging for cheques or by making the alternatives more attractive to customers. Cheques are also more costly for the issuer and receiver of a cheque. In particular the handling of money transfer requires more effort and is time consuming. The cheque has to be handed over in person or sent through mail. Experts have been looking for alternatives to the cheque. However, scrapping cheques would have had serious ramifications, not only for the elderly and most vulnerable in society, but also for small businesses and charities that rely on this payment method.

____

Money or postal order:

A cheque sold by a post office or bank for payment to the third party by a customer is referred to as a money order or postal order. These are paid for in advance when the order is drawn and are guaranteed by the institution that issues them and can only be paid to the named third party. This was a common way to send low value payments to third parties, avoiding the risks associated with sending cash via the mail, prior to the advent of electronic payment methods.

_____

The unbanked and the underbanked:

The word unbanked is an umbrella term used to describe diverse groups of individuals who do not use banks or credit unions for their financial transactions. They have neither a checking nor savings account. Some consumers are unbanked for a variety of reasons. These include: a poor credit history or outstanding issue from a prior banking relationship, a lack of understanding about banking system, a negative prior experience with a bank, language barriers, a lack of appropriate identification needed to open a bank account, or living paycheck to paycheck due to limited and unstable income. Underbanked consumers have either a checking or savings account, but also rely on alternative financial services. These households use non-bank money orders or non-bank check-cashing services, payday loan institutions, rent-to-own agreements or pawn shops on a regular basis. The most common groups of unbanked persons include low-income individuals and families, those who are less-educated, households headed by women, young adults and immigrants.

_

More than 2 billion adults worldwide, in both developed and developing countries, lack adequate access to banking services. Of this group, the majority isn’t excluded by choice; rather cost, distance, need, and other variables make it challenging or impossible to access banking services. Historically, banks and financial institutions haven’t seen this population as a lucrative group, because they tend to be low-income, drift in and out of the banking system, and don’t adopt high-value products, like credit. However, these populations are now becoming easier to access and, as a result, more attractive to financial institutions, because if products are scaled appropriately, they could represent a massive revenue stream. In response, financial institutions, mobile network operators (MNOs), and card networks are using digital technology like mobile phones and payment cards to access these populations in the hopes of building new streams of revenue in an increasingly competitive banking system. By leveraging phones and cards to build out financial ecosystems, hand financial access to broad swaths of people without it, and expand the range of services available to large populations, these firms have the opportunity to profit immensely. In a new report from BI Intelligence, let us take a close look at who the un- and underbanked are, the way financial institutions are using mobile phones and payment cards to access these populations, and whether there’s a profit opportunity for these stakeholders.

Here are some key takeaways from the report.

- The un- and underbanked provide an important new opportunity for payments companies that can leverage digital technology. Previously, these individuals were not seen as valuable clients because they are typically low income and, therefore, nonlucrative. But with digital technology available that can scale quickly, payments companies can gain significant market share and revenue.

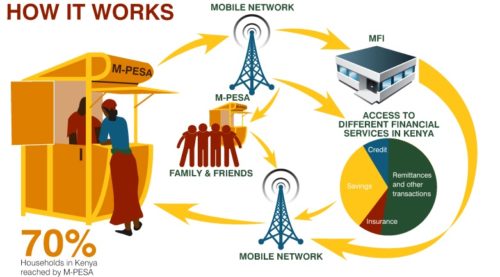

- Mobile phones are a key way of bringing the unbanked into the financial system through services like mobile money. And among the underbanked in developed countries, mobile provides account access in areas underserved by brick-and-mortar branches.

- Multiple players are teaming up to build payment card and point-of-sale (POS) infrastructure in developing countries in order to provide citizens without mobile phones secure, simple access to the banking system. In developed countries, prepaid cards are functioning as checking accounts for the un- and underbanked.

- For financial institutions, a small investment in the un- and underbanked can turn into a major revenue stream. Over time, these populations can build up larger balances or provide banks and card networks with interchange or interest-based fee revenue. In the next several years, digital technology will help make these populations a key competitive market.

_________

Digital money:

Since the world’s first gold coins were produced over 2500 years ago in Lydia, western Turkey, money has played a major role in stimulating commerce and economies. Money has traditionally been considered as medium of exchange and measure of value, allowing economic transactions to be conducted between strangers over time and distance. It has given rise to organised companies and public institutions and has been instrumental in helping communities to become more productive and to improve their standard of living. For a long time, money was embodied in precious metals such as gold and silver. With the introduction of banknotes in seventh century China, money started to decouple from physical objects with intrinsic value. Today’s electronic money can be moved from our employer, to our bank account, to our favourite retail outlets without ever physically materialising. It is this virtual money that now dominates what economists call the money supply. Given the intangible character of money, it is unsurprising that major advances in information technologies have led to radical changes in the way we deal with money and payments. In the 1960s, 1970s, and 1980s, computerisation encouraged financial innovations such as credit cards and ATMs. The impact of these innovations is profound, with Moody’s, for example, estimating credit cards added $1.1trn to private consumption and GDP from 2003 to 2008. In the 1990s, the wide adoption of the internet and World Wide Web led to online banking, online shopping and e-commerce in general. The relationship between information technology and money is now closer than ever, with lending, card issuance, deposits, payments and cash management increasingly conducted using digital media. Trends are clear: there is less and less cash in circulation in economies around the world, and a larger and larger percentage of payments are not in cash. Bills and coins now account for only seven percent of the USA’s total economic transactions, and an average of seven percent in the EuroZone. In Sweden, the first European country to introduce bank notes in 1661, only three percent of its economy is represented by bills and notes. Digital money is a collection of technologies and services that will profoundly affect every society and economy in the world. The transition to digital money involves the transformation of cash, cheques, credit and debit cards from physical to digital objects that we will carry in smart mobile devices. It also encompasses the whole global payment infrastructure, including the management of personal identities and personal financial data. Digital money will likely not eliminate cash, any more than the computerised office eliminated paper. In both cases, the digital and the physical will co-exist. But there are continuing problems with cash that digital money helps resolve. Notes and coins are unhygienic in the ways in which they transfer germs, and inefficient in the cost of storing, guarding and moving. Cash-based economies have great challenges in tax collection. Improving the flow of money can provide major economic and social benefits because it reduces time lost in making transactions, queuing for tickets etc, or waiting for receipts or confirmation of payments. It was not so long ago that time was continually lost in waiting for a cheque to be written, paid-in and cleared. Digital money has the potential to remove this ‘friction’ in transactions, improving and lubricating the flow of economic and social activities. This also has the potential to ‘dis-intermediate’ financial systems, because the use of digital money no longer makes it necessary to rely on intermediate services. International travellers, for example, have typically relied on foreign exchanges to change money into local currency, often paying much higher exchange rates than interbank spot rates. Foreign exchange companies have profited by running wide spreads between buying and selling foreign currencies. This traditional form of money exchange is rapidly disappearing as travellers are able to use ATMs linking them to their home bank accounts. The prospect of digital money is likely to improve access and flow still further.

_

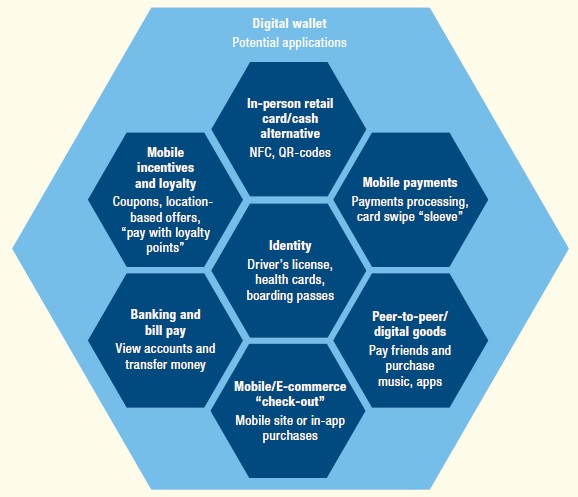

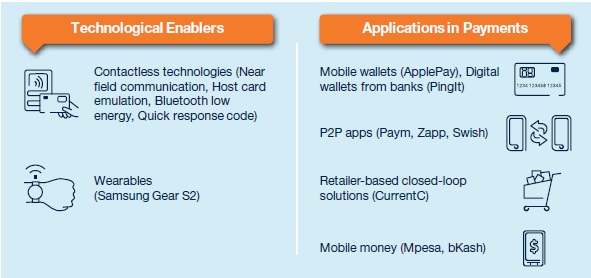

The ways we make payments are changing dramatically. Skidata, the Austrian company founded in 1977, was one of the first to develop mobile payment systems, originally providing electronic ticket access to turnstiles at ski resorts. In the late 1980s it was the first to provide hands-free ticketing. The diffusion of the technology has accelerated and the business has since grown to provide mobile contact-less access and transaction services in a wide range of areas such as sports and events, tourism and car parking. Consumers are readily embracing payments on smart phones. Major merchants accept mobile payments on the internet and at point-of-sale. Numerous transit and transportation systems use mobile payment. Innovations in ‘digital wallets’ run on smartphones include just about all the various items carried around in purses and wallets today that facilitate payments. The volumes of payment transactions are likely to go up by a few orders of magnitude over the next decades. In contrast to the billions of people disengaged from the banking system, the six billion mobile phone users worldwide bring unprecedented levels of connectivity. Banks and financial service companies are increasingly adopting mobile technologies to allow digital money transactions for millions for the first time. Indeed the impact of digital money will have a particularly profound effect on the world’s poorest, which is why organisations such as the World Bank and Bill and Melinda Gates Foundation are taking a strong interest in its implications and possibilities. Cash is especially disadvantageous for the poorest, who do not have the security of bank safes for their savings and are hampered by the inconvenience of transactions needing to be face-to-face rather than conducted electronically. The poor have no choice but to use cash. The emergence of digital money, which by receiving and making payments at such an increased scale lubricates the flow of innovation and economic development for all, including the poorest, presents both major opportunities and threats for citizens, corporations and governments.

______

Electronic money (Digital cash):

Electronic money is nothing more that the replacement of physical cash in the shape of coins and banknotes with an electronic equivalent. Digital cash is traditional bank money held on computers. Digital cash is a system that allows a person to pay for goods and services by transmitting a number from one computer to another. Like the serial numbers on real dollar bills, the digital cash numbers are unique. Each one is issued by a bank and represents a specified sum of real money. One of the key features of digital cash is that, like real cash, it is anonymous and reusable. Digital cash is also known as e-currency, e-money, electronic cash, electronic currency, digital money, digital currency and cyber currency, refers to a system in which a person can securely pay for goods and services electronically without necessarily involving a bank to mediate the transaction. Because the definition of electronic money is so broad as to include any sort of electronic device to store monetary value, the methods of electronic money are only limited to the existing technology. At present there are two main storage methods for electronic money, by software and by cards. The method of software money is a payment system where money is stored in a computer hard drive by means of a proprietary software program. The program creates an electronic wallet that is charged with money from a bank account, and then the user can purchase goods and services by sending the information via this electronic method. The transaction is encrypted and the identity of the user is kept hidden from the merchant. The most viable and promising electronic money system is that of storing monetary value in secure cards with microchips, known as smart cards.

_

From this definition it is obvious that electronic money is very much like physical money for all practical purposes. It is anonymous; it is given value by a financial institution; and it must be subject to be used to pay for goods and services in any sort of transaction. The new Electronic Money Institutions European Directive states that: ‘electronic money’ shall mean monetary value as represented by a claim on the issuer which is:

(i) stored on an electronic device

(ii) issued on receipt of funds of an amount not less in value than the monetary value issued

(iii) accepted as means of payment by undertakings other than the issuer

This definition is wide ranging, and attempts to be technology neutral.

_

Tatsuaki Okamoto and Kazuo Ohta list six properties of an ideal digital cash system:

- Independence. The security of the digital cash is not dependent on any physical location. The cash can be transferred through computer networks.

- Security. The digital cash can’t be copied and reused.

- Privacy (untraceability). The privacy of the user is protected; no one can trace the relationship between the user and his purchases.

- Off-line Payment. When a user pays for a purchase with electronic cash, the protocol between the user and the merchant is executed off-line. That is, the shop does not need to be linked to a host to process the user’s payment.

- Transferability. The digital cash can be transferred to other users.

- Divisibility. A piece of digital cash in a given amount can be subdivided into smaller pieces of cash in smaller amounts.

_

Since digital cash is merely an electronic representation of funds, it is possible to easily duplicate and spend a certain amount of money more than once. Therefore, digital cash schemes have been structured so that it is not possible to spend the same money more than once without getting caught immediately or within a short period of time. Another approach is to have the digital cash stored in a secure device, which prevents the user from double spending. Electronic money also encompasses payment systems that are analogous to traditional credit cards and checks. Here, cryptography protects conventional transaction data such as an account number and amount; a digital signature can replace a handwritten signature or a credit-card authorization, and public-key encryption can provide confidentiality. There are a variety of systems for this type of electronic money, ranging from those that are strict analogs of conventional paper transactions with a typical value of several dollars or more, to those (not digital cash per se) that offer a form of “micropayments” where the transaction value may be a few pennies or less. The main difference is that for extremely low-value transactions even the limited overhead of public-key encryption and digital signatures is too much, not to mention the cost of “clearing” the transaction with bank. As a result, “batching” of transactions is required, with the public-key operations done only occasionally.

_

Basic Model of Digital Cash transaction:

A Digital Cash transaction usually involves three types of users:

- a Payer or consumer

- a Payee, such as a merchant

- a financial network like a Bank with whom both Payer and Payee have accounts.

And usually involves three transactions:

- Withdrawal, the Payer transfer some money (token) from his/her bank account to his/her wallet

- Payment, the Payer transfer the money (token) to the Payee’s wallet or account.

- Deposit, the Payee receives money (token) to his/her account for selling goods and services; salary and debt repayment are also considered as deposits.

_____

The benefits of digital cash:

Electronic money has brought lots of new opportunities and possibilities. Using digital money is very easy and convenient. With electronic money, people can send mass payments to freelancers, remote workers, and others. It can also be used to pay for utilities, cell phone services, and internet access, transfer money to others, pay for goods and services online and offline, trade and much more. Electronic transactions are carried out almost instantly, while problems such as lines, change, and other are done away with. Digital cash saves not only time but money as well. All transfers within one payment system are available at a little to no cost. By using electronic money you stay anonymous and you are the only person who has access to your personal data. Electronic payment systems allow for anonymous payments. All account information is known only to the owner of that account, everyone else sees just a wallet number. In order to withdraw money or replenish your account balance, you don’t have to go anywhere, sign service agreements, present documents, and copies. Deposits and withdrawals come into effect immediately, all this can be done from home. With digital money, you have access to your account from anywhere and at any time. You’ll need only internet access to control your funds and perform operations. The number of services that accept electronic money is constantly growing.

_

_

Disadvantages of digital cash:

Although there are many benefits to digital cash, there are also many significant disadvantages. These include fraud, failure of technology, possible tracking of individuals and loss of human interaction. Fraud over digital cash has been a pressing issue in recent years. Hacking into bank accounts and illegal retrieval of banking records has led to a widespread invasion of privacy and has promoted identity theft. There is also a pressing issue regarding the technology involved in digital cash. Power failures, loss of records and undependable software often cause a major setback in promoting the technology. Privacy questions have also been raised; there is a fear that the use of debit cards and the like will lead to the creation by the banking industry of a global tracking system. Some people are working on anonymous e-cash to try to address this issue.

_________

Cash versus digital cash:

________

________

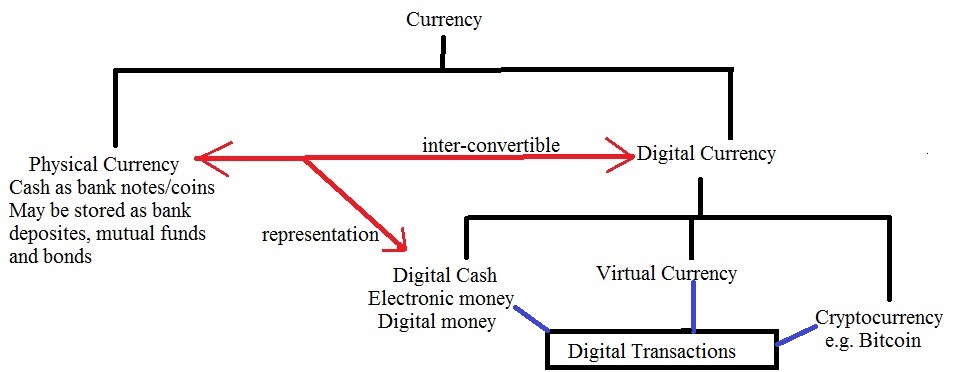

The difference between digital currency, virtual currency and cryptocurrency:

Digital currency can be defined as an Internet-based form of currency or medium of exchange distinct from physical (such as banknotes and coins) that exhibits properties similar to physical currencies, but allows for instantaneous transactions and borderless transfer-of-ownership. Both virtual currency and cryptocurrency are types of digital currencies but converse is not true. Although digital currency provides a host of features like ease-of-use, anonymity, efficiency there are potential issues with its use like tax evasion, money laundering, and instability in exchange rates and so on. Digital currencies are exactly what they sound like: currencies stored and transferred electronically. Any money based in 1’s and 0’s meets this definition; dollars stored in a bank account are supposed to be a representation of dollars actually held somewhere, whereas physical bitcoins are a representation of their digital counterparts. From the perspective of economic theory, whether a digital currency may be considered to be money depends on the extent to which it acts as a store of value, a medium of exchange and a unit of account. How far an asset serves these roles can differ, both from person to person and over time. And meeting these economic definitions does not necessarily imply that an asset will be regarded as money for legal or regulatory purposes.

Types of digital currencies:

- Virtual currency:

A virtual currency has been defined in 2012 by the European Central Bank as “a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community”. The US Department of Treasury in 2013 defined it more tersely as “a medium of exchange that operates like a currency in some environments, but does not have all the attributes of real currency”. The key attribute a virtual currency does not have according to these definitions, is the status as legal tender. Virtual currencies were developed because of trust issues with financial institutions and digital transactions. Though they aren’t even considered to be “money” by everyone, virtual currencies are independent of traditional banks and could eventually pose competition for them.

_

- Cryptocurrency:

A cryptocurrency is a type of digital token that relies on cryptography for chaining together digital signatures of token transfers, peer-to-peer networking and decentralization. A cryptocurrency is a digital asset designed to work as a medium of exchange using cryptography to secure the transactions and to control the creation of additional units of the currency. Cryptocurrencies are a subset of alternative currencies, or specifically of digital currencies. Bitcoin became the first decentralized cryptocurrency in 2009. Since then, numerous cryptocurrencies have been created.

_

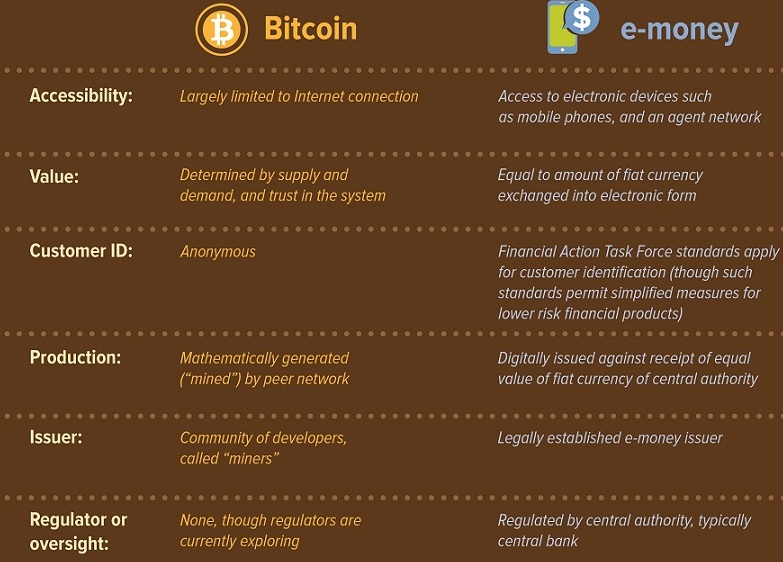

Bitcoin vs. digital cash:

_

_

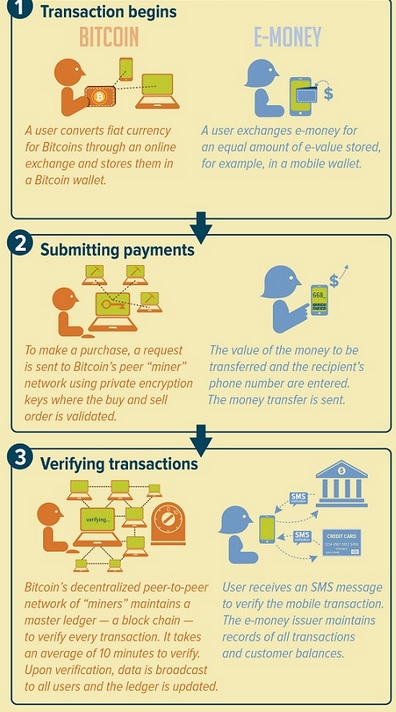

Digital transaction of Bitcoin vs. digital cash:

_

- Digital cash:

Most of the traditional money supply is bank money held on computers. This is also considered digital currency. One could argue that our increasingly cashless society means that all currencies are becoming digital (sometimes referred to as “electronic money”), but they are not presented to us as such.

_____

The synopsis of various currencies vis-à-vis digital transaction is depicted in the figure below:

_________

_________

Payment system:

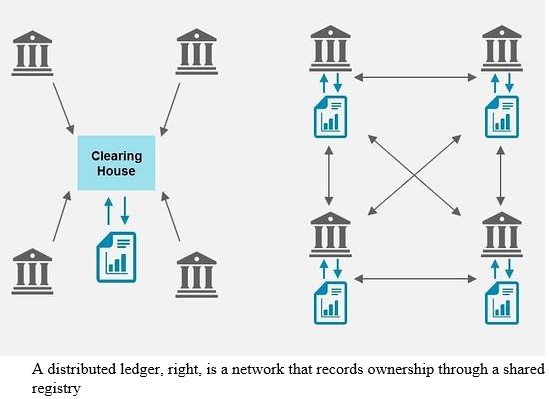

Money and payment systems are intrinsically linked. In order for an asset to function as a medium of exchange, there needs to be a secure way of transferring that asset — a payment system. And for any system other than the exchange of physical banknotes or coins, a means of recording the values stored is also needed — a ledger. The word “payment system” is a system that enables payment to be effected between a payer and a beneficiary, involving clearing(wherein the payment service provider acts as a counterparty between the buyer and seller by calculating the obligations between them and guaranteeing its settlement), payment (act of paying or transacting) or settlement service (the final act of changing the records of ownership of the asset transacted, either after netting all the cross obligations or on gross terms) or all of them. Modern payment systems are computerised and most money exists only as digital records on commercial banks’ accounts. Historically, payments have been viewed as utility products, fundamentally transactional and tactical in nature, undifferentiated and volume-driven. A payment was often perceived as merely the final step in a transaction, with limited opportunity to provide value-added services or solutions. However, this competitive landscape is getting redefined by the advent of non-traditional payment providers, evolution of new solutions, changing customer expectations and changing global demographics. A shift in global trade flows and the currency market’s role remains crucial in formulating the roadmap for invention and adoption of differentiated payment services. A vast geographical and demographic stretch lies beyond the formal payment system in emerging countries. This unbanked and under banked market has a huge revenue generation potential for financial institutions.

_

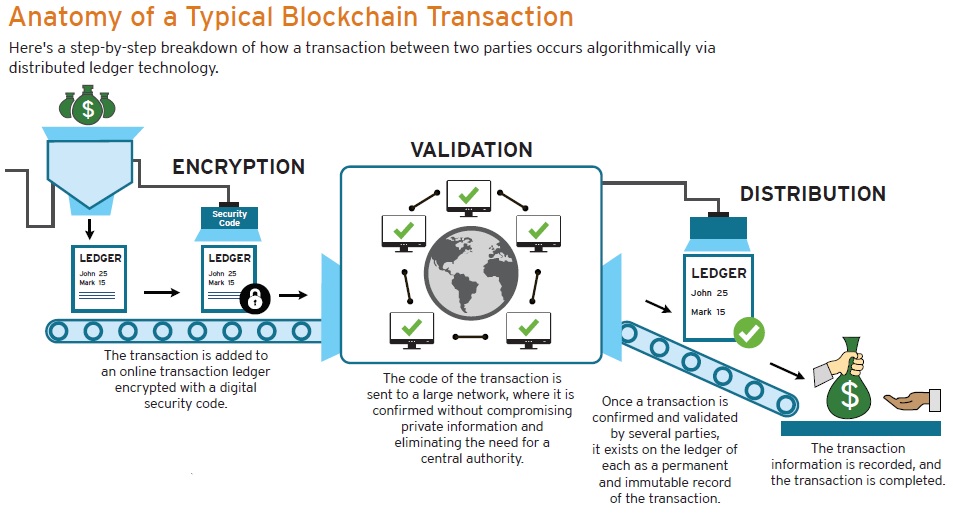

A payment system is any system used to settle financial transactions through the transfer of monetary value, and includes the institutions, instruments, people, rules, procedures, standards, and technologies that make such an exchange possible. A common type of payment system is the operational network that links bank accounts and provides for monetary exchange using bank deposits. What makes a payment system a system is the use of cash-substitutes; traditional payment systems are negotiable instruments such as drafts (e.g., checks) and documentary credits such as letters of credit. With the advent of computers and electronic communications a large number of alternative electronic payment systems have emerged. These include debit cards, credit cards, electronic funds transfers, direct credits, direct debits, internet banking and e-commerce payment systems. Some payment systems include credit mechanisms, but that is essentially a different aspect of payment. Payment systems are used in lieu of tendering cash in domestic and international transactions and consist of a major service provided by banks and other financial institutions.

_

Payment systems may be physical or electronic and each has its own procedures and protocols. Standardization has allowed some of these systems and networks to grow to a global scale, but there are still many country- and product-specific systems. Examples of payment systems that have become globally available are credit card and automated teller machine networks. Specific forms of payment systems are also used to settle financial transactions for products in the equity markets, bond markets, currency markets, futures markets, derivatives markets, options markets and to transfer funds between financial institutions both domestically using clearing and real-time gross settlement (RTGS) systems and internationally using the SWIFT network.

_

How to define digital payments?

Payments are made using payment instruments. Cash, for example, is a payment instrument. So too are checks. However, digital payments are not one instrument but rather an umbrella term applied to a range of different instruments used in different ways. Since there is no one standard definition of a digital or e-payment, you should settle on a clear and implementable definition at the start of any measurement exercise. The subject matter is complex, but there are two key dimensions of categorization that are most important:

- The nature of the payment instrument: through which means—paper or digital—are the instructions carried.

- The payer-payee interface: whether the payer, payee, or both use an electronic medium in a payment transaction.

_

Electronic (digital) payment:

The term electronic (digital) payment can refer narrowly to a payment for buying and selling goods and services offered through the Internet/private network, or broadly to any type of electronic funds transfer. It is transfers of value which is initiated and/or received using electronic devices and channels to transmit the instructions. Note that digitizing is often applied to processes other than payments: hence a government could digitize its accounting system, but still make payments by paper (check or cash).

_

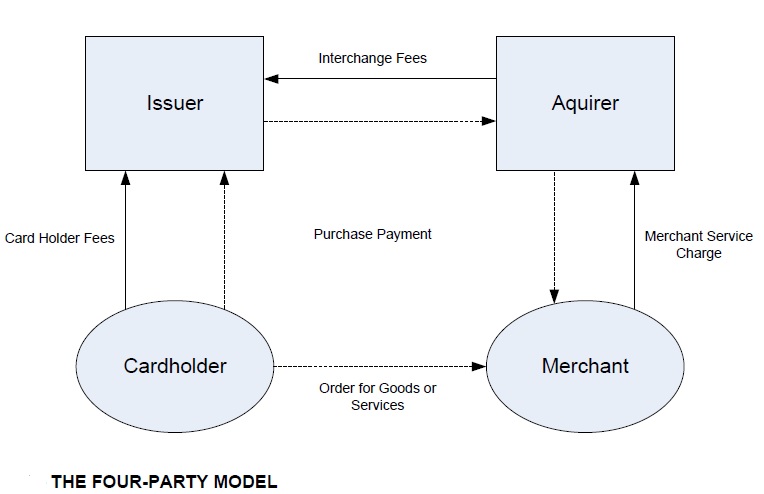

Who is acquirer Bank?

The bank which has acquired the transaction or the bank whose device has been used or the bank of the payee/ merchant.

Who is issuer Bank?

Issuer is the bank in which the user, customer or payer hold his/ her account.

_____

Broad definition of digital transaction:

Digital transaction is defined as sale or purchase of goods and services, whether between businesses, households, individuals, governments, and other public or private organisations, conducted over computer-mediated networks. Out of order, payment and delivery of goods and services, at least one must be conducted digitally over internet/private network to be classified as digital transaction. The relationship between information technology and money is now closer than ever, with lending, card issuance, deposits, payments and cash management increasingly conducted using digital media.

_

Narrow definition of digital transaction as proposed in India:

Digital transaction is defined as transaction in which the customer authorizes the transfer of money through electronic means, and the funds flow directly from one account to another. These accounts could be held in banks, or with entities/ providers. These transfers could be done through means of cards (debit / credit), mobile wallets, mobile apps, net banking, Electronic Clearing Service (ECS), National Electronic Fund Transfer (NEFT), Immediate Payment Service (IMPS), pre-paid instruments or other similar means.

_

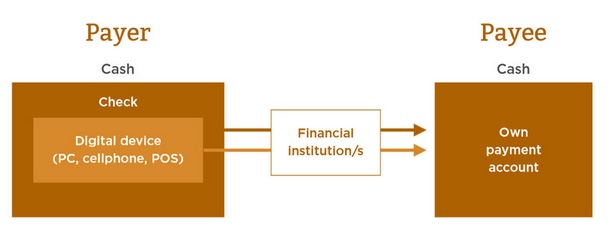

Digital transaction involve digital device to transfer fund:

_

Electronic payments systems can be divided broadly into two major categories:

- Cash-like systems that transfer money using electronic tokens that represent value with no intermediary instruments, instructions or services – such as a pre-paid e-wallet or electronic purse.

- Account-based systems that are used to transfer a numerical value that represents money, from one account to another. Account-based instruments such as cheques, money orders and credit cards are not money –but instead provide evidence of the intention and ability to pay via an account-based system

_

The various factors that have led the financial institutions to make use of electronic payments are:

- Decreasing technology cost:

The technology used in the networks is decreasing day by day, which is evident from the fact that computers are now dirt-cheap and Internet is becoming free almost everywhere in the world.

- Reduced operational and processing cost:

Due to reduced technology cost the processing cost of various commerce activities becomes very less. A very simple reason to prove this is the fact that in electronic transactions we save both paper and time.

- Increasing online commerce:

_

There are also many problems with the traditional payment systems that are leading to its fade out.

Some of them are enumerated below:

- Lack of Convenience:

Traditional payment systems require the consumer to either send paper cheques by snail-mail or require him/her to physically come over and sign papers before performing a transaction. This may lead to annoying circumstances sometimes.

- Lack of Security:

This is because the consumer has to send all confidential data on a paper, which is not encrypted, that too by post where it may be read by anyone.

- Lack of Coverage:

When we talk in terms of current businesses, they span many countries or states. These business houses need faster transactions everywhere. This is not possible without the bank having branch near all of the companies’ offices. This statement is self-explanatory.

- Lack of support for micro-transactions:

_

The problems in implementing electronic payment systems are:

- Preventing double-spending: copying the “money” and spending it several times. This is especially hard to do with anonymous money.

- Making sure that neither the customer nor the merchant can make an unauthorized transaction.

- Preserving customer’s confidentiality without allowing customer’s fraud.

___

There are several payment methods supporting electronic payments over the internet/private network:

- Electronic payment cards (credit, debit, and charge)

- Virtual credit cards

- E-wallets (or e-purses)

- Smart cards

- Electronic cash (several variations)

- Wireless payments

- Stored-value card payments

- Loyalty cards

- Person-to-person payment methods

- Payments made electronically at kiosks

_

Various technological methods of digital transactions:

1. Electronic Tokens:

An electronic token is a digital analog of various forms of payment backed by a bank or financial institution. There are two types of tokens:

a) Pre-paid tokens – These are exchanged between buyer and seller, their users pre-pay for tokens that serve as currency. Transactions are settled with the exchange of these tokens. Example include digital wallet.

b) Post Paid Tokens – are used with fund transfer instructions between the buyer and seller. Examples include credit/debit cards.

2. Electronic or Digital Cash:

This combines computerized convenience with security and privacy that improve upon paper cash. Digital cash can be transferred from payer’s account to payee’s account. Example includes net banking.

3. Electronic Cheques:

The electronic cheques are modelled on paper checks, except that they are initiated electronically. They use digital signatures for signing and endorsing and require the use of digital certificates to authenticate the payer, the payer’s bank and bank account. They are delivered either by direct transmission using telephone lines or by public networks such as the Internet.

____

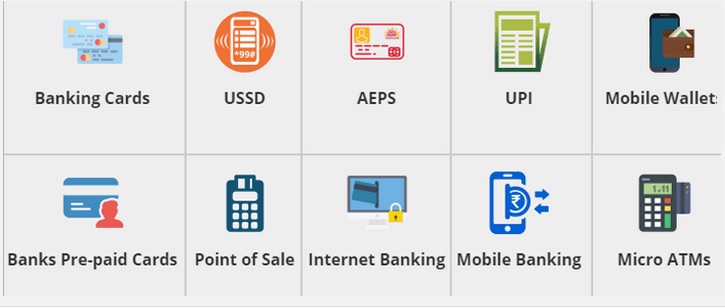

Overview of modes of digital transactions in India:

Remember, different countries have different modes of digital transactions.

_

Following are common modes of digital transactions:

- Automated Teller Machine (ATM): ATM is a combined computer terminal, with cash vault and record-keeping system in one unit, permitting customers to enter the bank’s book keeping system with a plastic card containing a Personal Identification Number (PIN). It can also be accessed by punching a special code number into the computer terminal linked to the bank’s computerized records. It is cash dispensing machines, deposits, funds transfer between two or more accounts and bill payments.

- Electronic Purses/Wallets: E-wallets that store card numbers and cash. This is a virtual wallet that can store credit card, debit card and other information.

- Electronic Funds Transfer at Point of Sale (EFT/POS): EFT/POS is an online system that involves the use of plastic cards in terminal on merchants’ premises and enables customers to transfer funds instantaneously from their bank accounts to merchant accounts when making purchases.

- Credit Cards: This is a plastic card for payment for the goods or items delivered.

- Debit Cards: These were a new form of value transfer, where the card holder after keying of a PIN, uses a terminal and network to authorize the transfer of value from their account to that of a merchant.

- Smart Cards: A smart card is a plastic card with a computer chip inserted into it and that store and transacts data between users.

- Mobile: A mobile payment is an electronic payment made through a mobile device (e.g., a cell phone or a PDA). This uses a mobile device to initiate and confirm electronic payment.

- Telephone Banking: Telephone banking or telebanking is a form of virtual banking that deliver financial services through telecommunication devices.

- Personal Computer Banking (Home Banking): This term is used for a variety of related methods whereby a payer uses an electronic device in the home or workplace to initiate payment to a payee.

- Online/Internet Payments: This is the means by which customers transact business with a bank through the use of the Internet network. Customers can access their bank accounts and make transfers through a website provided by the bank and complying with some rigorous security checks.

- Electronic Cheque: Electronic cheques are used in the same way as paper cheque – the clearing between payer and payee is based on existing and well known banking settlement system.

- Digitized ‘E-Cash’ Systems: E-cash payment system takes the form of encoded messages and representing the encrypted equivalent of digitized money.

- Digital P2P Payments: Bank-based P2P system allows users to send money from bank accounts and credit cards electronically. It employs e-mail services to notify recipients of an impending funds transfer.

_

Alternative payments:

Alternative payments refer to payment methods that are used as an alternative to credit card payments. Most alternative payment methods address a domestic economy or have been specifically developed for electronic commerce and the payment systems are generally supported and operated by local banks. Each alternative payment method has its own unique application and settlement process, language and currency support, and is subject to domestic rules and regulations. The most common alternative payment methods are debit cards, charge cards, prepaid cards, direct debit, bank transfers, phone and mobile payments, checks, money orders and cash payments.

_

Micropayment using digital cash transaction:

Internet transactions often involve micro payments, such as the sale of a cell phone ring tone for 50 cents. Credit card companies charge a fee for each transaction, so using a credit card to make these small purchases may cost more than the product itself. An electronic cash transaction does not need to use a credit card network, so the customer can avoid paying the credit card fee. A micropayment is a financial transaction involving a very small sum of money and usually one that occurs online. A number of micropayment systems were proposed and developed in the mid-to-late 1990s, all of which were ultimately unsuccessful. A second generation of micropayment systems emerged in the 2010s. There are a number of different definitions of what constitutes a micropayment. PayPal defines a micropayment as a transaction of less than £5 while Visa defines it as a transaction under 20 Australian dollars. While micropayments were originally envisioned to involve very small sums of money, practical systems to allow transactions of less than 1 USD have seen little success. One problem that has prevented the emergence of micropayment systems is a need to keep costs for individual transactions low, which is impractical when transacting such small sums even if the transaction fee is just a few cents.

_

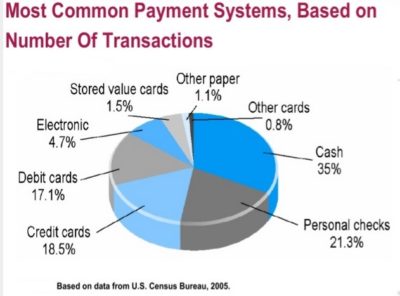

Comparison of payment systems:

Comparison of payment systems (also known as comparison of payment processing services, comparison of payment processors, or comparison of merchant services) is a list displaying comparative information and fee rates on various payment systems (also payment processing services, payment processor, or merchant services) for consumer use. Information such as these are compared and shown: seller’s/merchant’s fees, buyer’s fees, banking transfer fees, clearing-house fees, interchange fees, chargeback/return fees, currency conversion fees, monthly fees, usage, verification time, deposit time, technology support, customer-service quality, etc. Consumer can choose any type of digital payment system depending on transaction fees, time taken for transaction, convenience, privacy and security.

_

Default payments:

The recent growth of digital commerce is transforming consumer payments like never before. In particular, consumer behaviour dynamic called “default payments”—a payment made with credit card, debit card, and bank account details that have been stored for on-going and future transactions—is taking root in unexpected ways. Although it only accounts for 8% of retail sales today, e-commerce is growing at a faster clip than other channels, and is expected to reach $0.5 trillion by 2018. A study confirmed that default payments are already the dominant mode of payment in digital transactions, used extensively in online shopping, with mobile apps, and with mobile wallets at the physical point-of-sale (PoS) terminal. Mobile diary participants made 84%of their digital payments using default payment options.

_

Hidden payments:

Payments processed through non-bank systems are ‘hidden payments’ estimated to have reached 24-40 billion dollars in 2014. This would make them around 10% of non-cash payments, at the upper end of this range. ‘Hidden payments’ include those made through closed loop cards, mobile apps, digital wallets, mobile money and virtual currencies. The growing level of ‘hidden payments’ is a disintermediation threat for banks and those within the financial services industry. There are also wider implications for regulators and consumers around some elements of these payment methods. This includes dispute resolution, consumer protection, information security, privacy, fraud and anti-money laundering provisions.

_____

_____

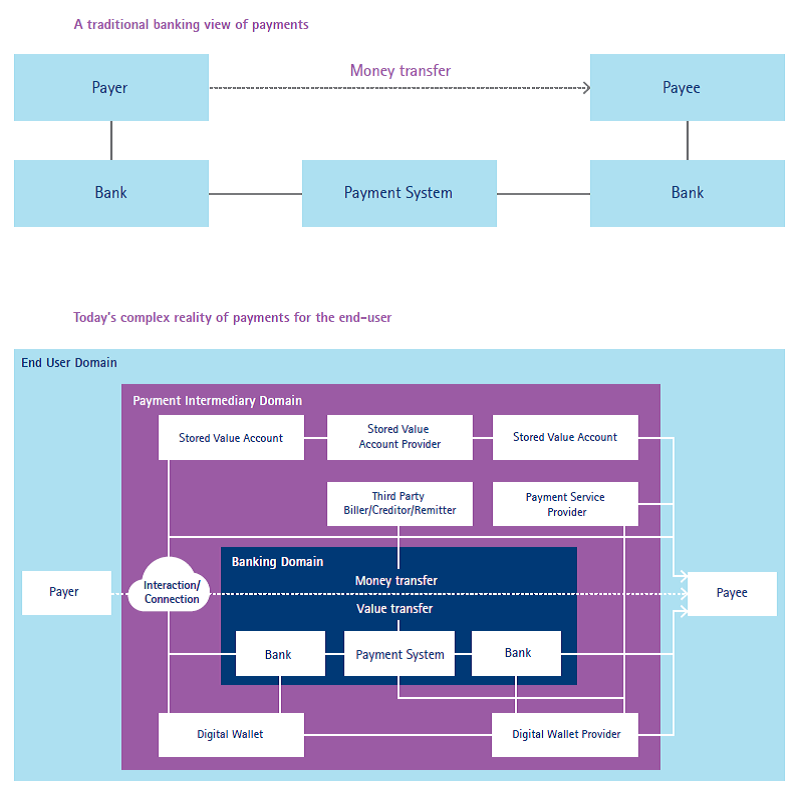

The figure below shows traditional and digital payment system:

____

____

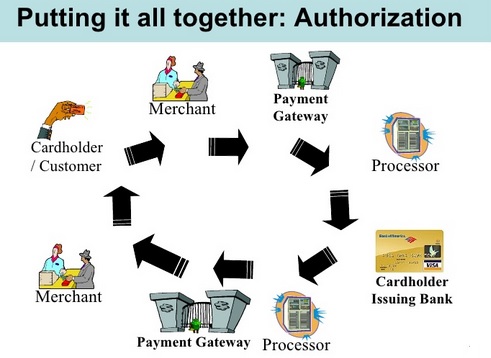

Payment gateway:

A payment gateway is a merchant service provided by an e-commerce application service provider that authorizes credit card or direct payments processing for e-businesses and online retailers. The payment gateway may be provided by a bank to its customers, but can be provided by a specialised financial service provider as a separate service. A payment gateway facilitates a payment transaction by the transfer of information between a payment portal (such as a website, mobile phone or interactive voice response service) and the front end processor of acquiring bank.

_

Payment service provider (PSP):

A payment service provider offers shops online services for accepting electronic payments by a variety of payment methods including credit card, bank-based payments such as direct debit, bank transfer, and real-time bank transfer based on online banking. Typically, they use a software as a service model and form a single payment gateway for their clients (merchants) to multiple payment methods. Typically, a PSP can connect to multiple acquiring banks, card, and payment networks. In many cases, the PSP will fully manage these technical connections, relationships with the external network, and bank accounts. This makes the merchant less dependent on financial institutions and free from the task of establishing these connections directly, especially when operating internationally. Furthermore, by negotiating bulk deals they can often offer cheaper fees. Furthermore, a full-service PSP can offer risk management services for card and bank based payments, transaction payment matching, reporting, fund remittance and fraud protection in addition to multi-currency functionality and services. Some PSPs provide services to process other next generation methods (payment systems) including cash payments, wallets, prepaid cards or vouchers, and even paper or e-check processing. A PSP is thus a much broader term than a payment gateway which is how the payment card industry refers to them. PSP fees are typically levied in one of two ways: as a percentage of each transaction or a fixed cost per transaction.

__

An Internet Merchant Account (IMA) allows merchants to accept debit/credit card payments directly to their business bank account, online. Due to the stringent criteria required for an Internet Merchant Account (IMA), many smaller businesses opt for a payment processing company instead. Using a Payment Gateway, provided by a Payment Service Provider (PSP) offers an alternative for businesses whose card-based-turnover is too low or who fail to meet the criteria for an Internet Merchant Account (IMA). AT Integrated ecommerce platform includes and automates all technical aspects of accepting online payments. It can accept online payments using a combination of online payment processors at the same time

_

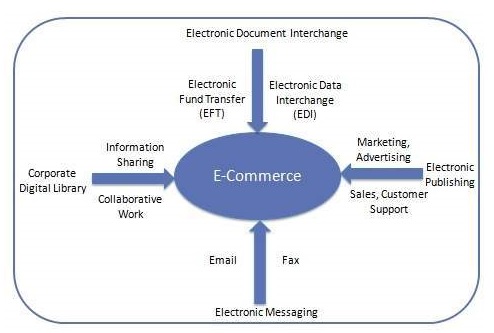

Online payment process:

Online payment refers to money that is exchanged electronically. Typically, this involves use of computer networks, the internet and digital stored value systems. When you collect a payment over the internet, you are accepting an online payment. Online payment usually is the transaction that results in transfer of monetary funds from the customer bank or credit card account to your bank account. The online payment can be done from a credit card, checking account or other clearing house like PayPal for example. Merchants accepting online payments need to comply with a list of security requirements. The online payment specific security is designed to decrease the chance of the billing and personal information being stolen. The transfer needs to occur over secure encrypted connection. In the cases of recurring billing where customer data is stored, the merchant needs to enforce a longer list of security features and protocols that are usually referred to as PCI (Peripheral Component Interconnect) compliance requirements. Recurring billing systems that employ online payment procedures need to be periodically scanned for security vulnerabilities. To accept an online payment the merchant needs to have access to an Online Payment Gateway. The online payment gateway is a service provider that is integrated with the credit card and transfers the online payment information between the merchant and the payment processor. An e-commerce online payment system facilitates the acceptance of electronic payment for online transactions. Also known as a sample of Electronic Data Interchange (EDI), e-commerce online payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking.

The typical online payment process has the following stages:

- Customer submits the payment information to the merchant. For example customer completes the payment form on the merchant website and submits the information.

- The merchant submits the payment information to the online payment gateway.

- The online payment gateway submits the payment to the payment processor.

- The payment processor authorizes the payment and responds to the payment gateway

- The payment gateway responds back to the merchant

- The merchant responds back to the customer showing if the online payment was successful or not and taking the appropriate action.

_______

_______

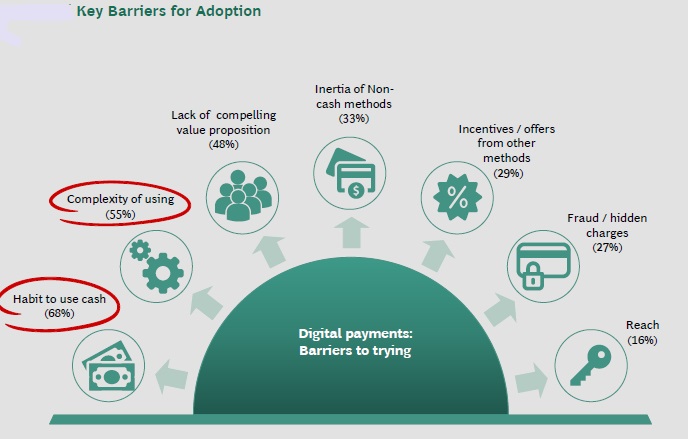

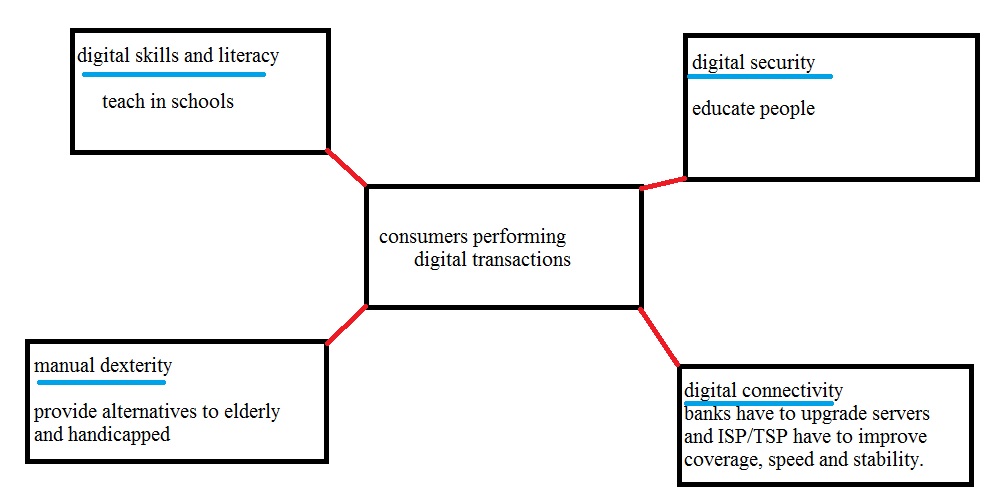

The figure below shows key barriers for adoption of digital transactions in India:

Barriers to adoption of digital transaction differ from country to country.

_____

_____

Pros and Cons of digital payment and digital transactions:

Digital payments have several advantages, which were never available through the traditional modes of payment. Some of the most important are:

– Privacy

– Integrity

– Compatibility

– Good transaction efficiency

– Acceptability

– Convenience

– Mobility

– Low financial risk

– Anonymity

- Perhaps the greatest advantage of e-payments is the convenience. Individuals can pay their bills and make purchases at unconventional locations 24 hours a day, 7 days a week, 365 days a year. There is no waiting for a merchant or business to open. Vacationers and others away from home need not worry that they forgot to drop off the payment for the utilities or mail the check for their credit card bill. They can simply pull up their account online and pay their bills on the road.

- This leads to the second best benefit of e-payments- they save time. Once the initial set-up of the payment system for each account is completed, an individual can pay his bills in a flash. In a research study Marketwatch.com found that the average American, who writes checks and mails them for payment, spends over 24 hours during the course of a year paying bills. E-payments have reduced the amount of time spent on bill management or payment by about 60%. This has given busy individuals more time to spend doing those things they enjoy.

- The cost of e-payments is yet another benefit. For the majority of merchants, vendors, and businesses, there is no fee or charge to pay online. For others, the fee is nominal. While there are no additional charges for making a cash payment, trips to the store typically cost money, and checks also need postage. Compared to the cost of postage, check writing fees and trips to the post office, individuals paying their bills online can save hundreds of dollars per year. In this day and age, reducing expenses is quite important for many individuals.

- Despite the belief of many to the contrary, e-payments are secure. They may even be more secure than the old fashion way of mailing in a check. According to most sources, most instances of identity theft occur by stealing mail out of a person’s mailbox or from discarded trash, not over the Internet. Encryption technology allows an individual’s personal financial data to be scrambled before it is sent electronically. It also lowers the risk of human error by reducing the number of people touching the payment once it leaves the payer.

- Transparency and tax coverage: Transparency can be brought to system by digital transactions. For example, 20 million fake ration cards were weeded out and 42000 million leaks were plugged on digitization of Public Distribution System in India. Similar advantages can be tapped out by digitizing payments on other Government projects like infrastructure. Only 3 percent of over 1.3 billion people in India are estimated to pay income tax. This percentage can be significantly improved if tax authorities have information on people with informal income sources other than salaries.

- Increased Sales: As Internet banking and shopping become widespread, the number of people making cash payments is decreasing. In a 2014 survey, Bankrate established that more than 75 percent of those surveyed carry less than $50 a day, meaning electronic alternatives are increasingly becoming the preferred payment option. As such, e-payment enables businesses to make sales to the customers who choose to pay electronically and gain a competitive advantage over those that only accept traditional methods.

___

On the flip side, with so many benefits to using e-payments, it’s important to remember that there are negative aspects too. Some of the biggest downsides of e-payments are the lack of authentication, repudiation of charges and credit card fraud. There is no way to authenticate or verify that the individual entering the information online is who they say they are. There is no request for picture identification or even a signature. Therefore, an unauthorized user may carry out transactions in your name before you have time to alert authorities the information has been taken. Because no identifying information is provided at the time of the online payment, an individual may have an extremely hard time disputing a charge later. Further, given the benefits of convenience and speed that come along with e-payments, this creates the perfect opportunity for fraudulent credit card transactions. One of the other disadvantages of e-payments is that most sites require you to open an online account with them. You need to register with the institution in order to be authorized to perform money transactions with them. While the overall payment process is efficient, the initial registration to a given site can be time-consuming. It also involves a username and a password, which implies the need of password protection, to maintain an e-payment account at each organization. If a person has more than one or two accounts, e-payments can become extremely cumbersome. At times, there occur millions and millions of requests at a time which gets difficult to handle. In case of hardware failures of the online transaction processing systems, visitors of website get in trouble and their online transactions get effected. Electricity problem is another issue, i.e. if there is shortage in electric supply additional backup facilities like generators and related hardware is a must. The fundamental of operation of online transaction systems is atomicity. Atomicity ensures that if any step fails in the process of transaction, the entire transaction must fails, due to which the same steps have to be repeated again and again while filling forms which causes dissatisfaction among buyers.

_____

Electronic Payment System Disadvantages:

- Internet Connection:

Not everyone enjoys the luxury of having a stable and fast Internet connection at home. Aside from having a personal computer or laptop, having stable Internet access at home is a basic prerequisite to performing electronic banking. Of course, people can always use a public computer with Internet access; however, the security of public computers is always a concern.

- Computer Know-How:

Conducting a successful electronic banking transaction, like paying bills online, requires basic computer skills and knowing your way around the Internet. Being computer-literate is not common to everyone—especially seniors who might not have grown up using computers—and this is a major disadvantage to electronic banking.

- Loss of Human Touch:

Some people still value talking and interacting with bank tellers, managers and other bank clients. Electronic banking takes the majority of these “human interactions” away, leaving the banking experience as a very hands-off, impersonal process.

- Password Threats:

In case of e-banking or online financial transactions, you need to be a registered user with the respective website. Though most transactions involve the use of one-time passwords thus ensuring safety to a considerable extent, some parts of a transaction, or your personal details and bank account information is accessible through your credentials for the online portal. This gives rise to the need of password protection when handling financial accounts online. Also, if you are transacting with multiple financial institutions or have accounts with multiple banks, the risk of privacy breach is multiplied. For some, maintaining multiple accounts online feels tedious.

- Limitations on Amount and Time:

For withdrawal or fund transfer, certain banks may impose limits on the amount or the number of daily transactions, whereby an amount exceeding a certain figure cannot be withdrawn at once, or only a certain number of transactions are allowed per day. While this is taken as a safety measure, some may find it inconvenient. The access to money may be delayed in case of electronic modes as against having physical access to money. In case of taking electronic payments, the payment terms may need to be longer. When different electronic payment services do not cooperate with one another, e-currency exchange services may need to be opted for.

- Security Concerns:

One of the biggest disadvantages of doing electronic banking is the question of security. With the prevalence of keyloggers, phishing emails, trojans and other online threats, it is natural for people to be concerned with the security of their identity, funds and electronic banking transactions. Using antivirus and similar programs is not full-proof. People worry that their bank accounts can be hacked and accessed without their knowledge or that the funds they transfer may not reach the intended recipients. When transacting online, your personal or account information and credit card number is exposed over the Internet. This leads to the risk of your account being hacked. Hackers may use your identity for fraudulent activities or make huge fund transfers from your account, which could mean financial losses for you.

- False Identity:

There are no means to verify if the person entering information online is the same person he claims to be. This is because unlike physical transactions, the individual is not present in person, and one’s identity is not verified using a photograph or a physical signature. Mostly, electronic cash transactions are based on cryptographic systems. Information being transferred is encoded by means of numeric keys when the transaction details travel across the web. Though electronic payments carry less risk of forgery, the keys are vulnerable to attack.

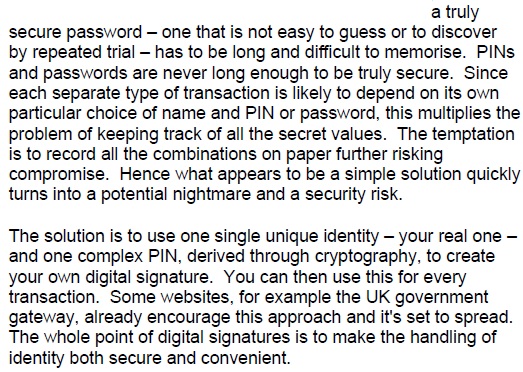

- Anonymity and Privacy Concerns: