Dr Rajiv Desai

An Educational Blog

ECONOMY FOR PEOPLE

ECONOMY FOR PEOPLE:

Prologue:

Despite being an intelligent doctor, I could not become rich because I did not compromise between my way of thinking and the thinking of others in my environment no matter whether others include spouse or family members or patients or friends or courts. I could not become corrupt no matter how many opportunities came in life. I know of many doctors who became rich by simply buying and selling lands rather than medical acumen but I could not even do that. I was perceived to be weak in economics by both friends and foes alike. I work in government hospital on contract basis and get rupees 30,000 per month as salary wages. I earn this money because I got MD degree and 23 years of experience in treating human illnesses. The money is paid by the people of India. Do all the people pay? No. 70 % Indians survive on less than rupees 20 per day and obviously they can not contribute to my salary. So it is the remaining 30 % population belonging to middle class & rich class who pay taxes which reimburse my salary. Those 30 % population hardly ever come for free treatment in government hospital but the remaining 70 % population who did not contribute to my salary always come to me for treatment. So the hard working tax paying class pays for treatment of poor. Who benefits? The politicians who get votes from these poor people for free treatment given from money of tax paying class. Electoral statistics from most democratic nations shows that only 50 to 60 % of population votes and out of them, majority are poor. Politicians exploit poor people to grab their votes under pretext of helping them. So the net result is that I earn money from tax paying class and the benefit goes to poor who votes for politicians so that they make such policies in future to give poor more and more benefits without hard work like subsidized kerosene and subsidized rice etc. So the vicious cycle continues. Poor remains poor but get all the subsidies and therefore votes for politicians to continue subsidies and in return, politicians keep on making policies that give benefit to poor from hard earned money of tax paying class. Then, corruption sets in. The same politicians, bureaucrats and businessmen extract money from this vicious cycle to become rich. So poor remains poor, middle class remains middle class and elite remain elite, and tax payer’s money is distributed to those who do nothing since morning to evening and those who are corrupt. Is this the way economy should develop? So I decided to go in the detail of economy. Even though I am a student of science, I decided to venture into an unknown area with curiosity and caution. With this article, I am trying to break my jinx in economics. I would not be dismayed if I am not successful in this endeavor as I have no knowledge or experience in economics. People who could not become rich despite being intelligent & hard working can learn something from this article.

Economy means the production, exchange, distribution, and consumption of goods & services of an area; using labor, capital and land resources; and the economic agents that participate in the process. The economy functions within conditions & parameters of various factors like technological evolution, history, social organization, geography, natural resource endowment, and ecology. Practical fields range from engineering to management and from business administration to applied science to finance. The English words “economy” and “economics” can be traced back to the Greek words meaning “one who manages a household”. The most frequently used current sense, “the economic system of a country or an area” seems not to have developed until the 19th or 20th century.

Economics is the social science that analyzes the production, distribution, and consumption of goods & services with the theory and management of economies or economic systems. Economics aims to explain how economies work and how economic agents interact. Economics per se, as a social science, is independent of the political acts of any government or other decision-making organization, however, many policymakers or individuals holding highly ranked positions that can influence other people’s lives by arbitrarily using plethora of economic concepts. An economist is a professional in the social science discipline of economics. The first economist in the true meaning of the word was the Scotsman Adam Smith (1723–1790). He defined the elements of a national economy: products are offered at a natural price generated by the use of competition – supply and demand – and the division of labour. He maintained that the basic motive for free trade is human self interest. The so-called self interest hypothesis became the anthropological basis for economics. Thomas Malthus (1766–1834) transferred the idea of supply and demand to the problem of overpopulation. The Industrial Revolution was a period from the 18th to the 19th century where major changes in agriculture, manufacturing, mining, and transport had a profound effect on the socioeconomic and cultural conditions starting in the United Kingdom, and then subsequently spreading throughout Europe, North America, and eventually the world. The period today is called industrial revolution because the system of production and division of labour enabled the mass production of goods. After the chaos of two World Wars and the devastating Great Depression, policymakers searched for new ways of controlling the course of the economy. It was John Maynard Keynes (1883–1946), who argued for a stronger control of the markets by the state and the theory that the state can alleviate economic problems and instigate economic growth through state manipulation of aggregate demand. In the late 1950s the economic growth in America and Europe (economic miracle) – brought up a new form of economy: mass consumption economy.

The primary textbook distinction exits between the microeconomics which examines the behavior of basic elements in the economy including individual markets and agents (such as consumers & firms, buyers & sellers) and the macroeconomics, which addresses issues affecting an entire economy including unemployment, inflation, economic growth, and monetary & fiscal policy. Microeconomics is the study of decisions that people & businesses make regarding the allocation of resources and prices of goods & services. This means also taking into account taxes and regulations created by governments. Microeconomics focuses on supply & demand and other forces that determine the price levels seen in the economy and how prices, in turn, determine the quantity supplied and the quantity demanded of goods and services. Macroeconomics, on the other hand, is the field of economics that studies the behavior of the economy as a whole and not just on specific companies, but entire industries and economies. Macroeconomists study aggregated indicators such as GDP, unemployment rates, and price indices to understand how the whole economy functions. Macroeconomists develop models that explain the relationship between such factors as national income, output, consumption, unemployment, inflation, savings, investment, international trade and international finance. The bottom line is that microeconomics takes a bottoms-up approach to analyzing the economy while macroeconomics takes a top-down approach.

The four basic laws of supply and demand are:

1) If demand increases and supply remains unchanged then higher equilibrium price and quantity.

2) If demand decreases and supply remains the same then lower equilibrium price and quantity.

3) If supply increases and demand remains unchanged then lower equilibrium price and higher quantity.

4) If supply decreases and demand remains the same then higher price and lower quantity.

At least two assumptions are necessary for the validity of this standard model: first, that supply and demand are independent; and second, that supply is “constrained by a fixed resource”. If these conditions do not hold, then the above model cannot be sustained. The intent of mass production is to produce in extremely large quantities at the lowest possible cost so as to drive down price and create demand. In the case of mass production, both the assumptions of supply and demand being independent and constraints on supply are not applicable.

An economic system is the structure of production, allocation of economic inputs, distribution of economic outputs, and consumption of goods and services in an economy. Examples of contemporary economic systems include capitalist systems, socialist systems, and mixed economies.

Capitalism:

Capitalism is an economic system in which the means of production are privately owned and operated for a private profit; decisions regarding supply, demand, price, distribution, and investments are made by private actors in the market rather than by central planning by the government; profit is distributed to owners who invest in businesses; and wages are paid to workers employed by businesses and companies. There is no consensus on the precise definition of capitalism, nor how the term should be used as an analytical category. There is however little controversy that private ownership of the means of production, the creation of goods & services for profit in a market, and private decisions regarding prices & wages are elements of capitalism. Economists usually emphasize the degree that government does not have control over markets and on property rights.

A product is any good produced for exchange on a market. There are two types of products: capital goods and consumer goods. Capital goods (i.e. raw materials, tools, industrial machines, vehicles and factories) are used to produce consumer goods (e.g., televisions, cars, computers, houses) to be sold to others. The three inputs required for production are labor, land (i.e., natural resources) and capital goods. Capitalism entails the private ownership of the latter two – natural resources and capital goods – by a class of owners called capitalists, either individually, collectively or through a state apparatus that operates for a profit or serves the interests of capital owners. Money is primarily a standardized medium of exchange and final means of payment, which serves to measure the value all goods and commodities in a standard of value and besides that, money is also having a store value, similar to precious metals. Individuals engage in a capitalist economy as consumers, laborers, and investors. As laborers individuals may decide which jobs to prepare for, and in which markets to look for work. As investors they decide how much of their income to save and how to invest their savings. These savings which become investments provide much of the money that businesses need to grow. An economy grows when the total value of goods and services produced rises. This growth requires investment in infrastructure, capital and other resources necessary in production. In a capitalist system, businesses decide when and how much they want to invest.

In a capitalist economy, the prices of goods and services are controlled mainly through supply and demand and competition. Supply is the amount of a goods & service produced by a firm and which is available for sale. Demand is the amount that people are willing to buy at a specific price. Prices tend to rise when demand exceeds supply, and fall when supply exceeds demand. In theory, the market is able to coordinate itself when a new equilibrium price and quantity is reached. Competition arises when more than one producer is trying to sell the same or similar products to the same buyers. In capitalist theory, competition leads to innovation and more affordable prices. Without competition, a monopoly may develop. A monopoly occurs when a firm supplies the total output in the market; the firm can therefore limit output and raise prices because it has no fear of competition. In a capitalist system, the government does not prohibit private property or prevent individuals from working where they please. The government does not prevent firms from determining what wages they will pay and what prices they will charge for their products. Many countries, however, have minimum wage laws and minimum safety standards.

Advantage of capitalistic economy is sustained economic growth, political freedom and self-organization. Criticism of capitalistic economy include the unfair distribution of wealth and power; a tendency toward market monopoly; imperialism, economic exploitation; repression of workers and trade unionists, and phenomena such as social alienation, economic inequality, unemployment, and economic instability. Environmentalists have argued that capitalism requires continual economic growth, and will inevitably deplete the finite natural resources of the earth.

Capitalism is characterized by the division of labor between worker and capitalist, in which the means of production are separated from the direct producers and are instead owned by a parasitical capitalist class. Marx and Engels believed that under capitalism, the working class produces surplus value, of which only a small percentage is returned to workers in the form of wages to provide for their bare subsistence. The rest of the surplus value is kept as profit, and is reinvested into the commodity cycle by the capitalist. The competitive forces of the market will drive capital to constantly accumulate “for the sake of more accumulation”, resulting in monopolies, economic crisis, imperialism and wealth accumulation with capitalist on one hand; and mass poverty, starvation, urbanization & pauperization for much of the population on the other hand. The declining living conditions of the working class would drive workers to collectively fight back as part of a class struggle, eventually overthrowing the capitalist state in a proletarian revolution and establishing a democratically planned economy, in which production is controlled by the direct producers themselves – the proletariat – in order to satisfy human needs, not accumulation of profits. The first centrally planned economy was established after the Russian Revolution of 1917, led by the Bolshevik Party, in which production (and social life) was organized around workers’ councils called soviets and subsequently, similar councils of democratically elected recallable worker delegates have existed in subsequent revolutions and revolutionary situations throughout the 20th Century in other countries.

Communism & socialism:

Communism is a sociopolitical movement that aims for a stateless and classless society structured upon common ownership of the means of production, free access to articles of consumption, the end of labour wages & private property on the means of production and real estate. Even though the term communism and socialism are used interchangeably, Marxist theory contends that socialism is just a transitional stage on the way to communism. Primary criticisms of socialism and by extension communism are distorted or absent price signals, slow or stagnant technological advance, reduced incentives, reduced prosperity & feasibility and its social and political effects. The policies adopted by one-party states ruled by communist parties have lead to worst human right violations and plenty of deaths from famines, purges and warfare, far in excess of previous empires, capitalist or other regimes. Market mechanisms have been utilized in a handful of socialist states, such as China and Cuba to a very limited extent. If you put too much socialism in any capitalist system, capitalist economic system will collapse. This happens due to the overburden of socialism or too much money being taken out of the private sector and redistributed to other sectors of the economy that isn’t producing anything. There is always a tipping point and socialist nations have reached it. Socialism has never worked in any shape or form. Here’s some really big proofs were socialism has been tried for many years and failed miserably right from the start. First look at Russia. They ran a communist economic system for 70 years and their people lived in severe poverty. Then they changed into a capitalist system and their standard of living increased by 500%. Then we have to take a look at communist China. They tried communism for over 30 years and for 30 years their people lived in severe poverty just as Russia. Once they changed over to capitalism, they too experience the same 500% increases in their standard of living. So it’s a choice whether you want to live in severe poverty under socialism or you want live through high standard of living that people have in western nations. The example I have narrated in the Prologue of this article clearly demonstrate socialism in India where overpopulating poor who do nothing are fed & treated from the money of tax paying class by socialist economic policies. This will not work. This will not bring prosperity. The only way out is to control population and give jobs to poor so that they can earn their money and not survive on subsidies & welfare.

Mixed economies:

Mixed economy means a largely market-based economy consisting of both public ownership and private ownership of the means of production. A mixed economy is a mixture of capitalism and socialism.

Market economy versus planned economy:

A market economy is a term used to describe an economy where economic decisions such as pricing of goods and services are made in a decentralized manner by the economy’s participants and manifested by trade. This can be seen as a “bottom-up” approach to organizing an economy (self-organization). It is in contrast to a planned economy, where economic decisions are made by a central agency which can be equated to a “top-down” approach. The key difference between market economies and planned economies lies not with the degree of government influence but with how that influence is used. In a market economy, if the government wants more steel, it collects taxes and then buys the steel at market prices. In a planned economy, a government which wants more steel simply orders it to be produced. In the real world, market economies do not exist in pure form as societies and governments regulate them to varying degrees rather than allow self-regulation by market forces. The term free-market economy is sometimes used synonymously with market economy. The term market economy is not identical to capitalism where a corporation hires workers as a labor commodity to produce material wealth and boost shareholder’s profits. Basic criticism of market economy is that markets inherently produce class division; divisions between conceptual & manual laborers, and ultimately managers & workers, and a de facto labour market for conceptual workers.

A social market economy is a nominally free-market system where government intervention in price formation is kept to a minimum, but the state provides for moderate to extensive provision of social security, unemployment benefits and recognition of labor rights through national collective bargaining schemes.

Private sector & public sector:

In economics, the private sector is that part of the economy which is run by private individuals or groups, usually as a means of enterprise for profit, and is not controlled by the state. The private sector employs the majority of the workforce in western nations but in some countries such as the People’s Republic of China, the public sector employs most of the workers. The Public Sector (state sector) is a part of the state that deals with the production, delivery and allocation of goods & services by and for the government or its citizens; whether national, regional or local/municipal. Examples of public sector activity range from delivering social security, administering urban planning and organizing national defenses. In general, socialists favor a large public sector consisting of state projects and enterprises, social democrats tend to favor a medium-sized public sector that is limited to the provision of universal programs and public services. The economic libertarians & minarchists favor a small public sector with the state being relegated to protecting property rights, creating & enforcing laws and settling disputes. The public companies (public limited) are not part of the public sector; they are a particular kind of private sector companies that can offer their shares for sale to the general public.

The ancient economy was mainly based on subsistence farming. The industrial revolution lessened the role of subsistence farming, converting it to more extensive and mono-cultural forms of agriculture in the last three centuries. The economic growth took place mostly in mining, construction and manufacturing industries. In the economies of modern consumer societies, there is a growing part played by services, finance, and technology – the (knowledge economy). Over the past millennium, world population rose 22 – fold, per capita income increased 13 – fold and world GDP nearly 300 – fold. This contrasts sharply with the preceding millennium, when world population grew by only a sixth, and there was no advance in per capita income.

In modern economies, there are four main sectors of economic activity.

1) Primary sector of the economy: The primary sector of the economy involves changing natural resources into primary products. Most products from this sector are considered raw materials for other industries. Major businesses in this sector include agriculture, agribusiness, fishing, forestry and all mining and quarrying industries. For example, this sector is involved in the extraction and production of raw materials such as corn, coal, wood and iron. A coal miner and a fisherman would be workers in the primary sector. Primary industry is a larger sector in developing countries. In developed countries primary industry becomes more technologically advanced, for instance the mechanization of farming as opposed to hand picking and planting.

2) Secondary sector of the economy: The secondary sector of the economy includes those economic sectors that create a finished & usable product. This sector generally takes the output of the primary sector and manufactures finished goods or where they are suitable for use by other businesses, for export, or sale to domestic consumers. This sector is often divided into light industry and heavy industry. Many of these industries consume large quantities of energy and require factories and machinery to convert the raw materials into goods and products. They also produce waste materials and waste heat that may pose environmental problems or cause pollution. For example, this sector is involved in the transformation of raw or intermediate materials into goods like cars from steel, clothing from textiles etc. A builder and a dressmaker would be workers in the secondary sector. Among developed countries, it is an important source of well paying jobs for the middle class to facilitate greater social mobility for successive generations on the economy.

3) Tertiary sector of the economy: This sector is involved in activities where people offer their knowledge and time to improve productivity, performance, potential, and sustainability. The basic characteristic of this sector is the production of services instead of end products. Services include attention, advice, experience, and discussion. For example, this sector involves the provision of services to consumers and businesses such as baby-sitting, cinema and banking. A shopkeeper and an accountant would be workers in the tertiary sector. Services may involve the transport, distribution and sale of goods from producer to a consumer, as may happen in wholesaling and retailing, or may involve the provision of a service such as in pest control or entertainment & restaurant industry. The tertiary sector is now the largest sector of the economy in the Western world, and is also the fastest-growing sector.

4) Quaternary sector of the economy: The quaternary sector of the economy is a way to describe a knowledge-based part of the economy which typically includes services such as information generation & sharing, information technology, consultation, education, research & development, financial planning, and other knowledge-based services. For example, this sector involves the research and development needed to produce products from natural resources. A logging company might research ways to use partially burnt wood to be processed so that the undamaged portions of it can be made into pulp for paper. Note that education is sometimes included in this sector. This sector evolves in well developed countries and requires a highly educated workforce.

There are a number of ways to measure economic activity of a nation. These methods of measuring economic activity include: Consumer spending, Exchange Rate, Gross domestic product (GDP), GDP per capita, GNP, Stock Market, Interest Rate, National Debt, Rate of Inflation, Unemployment, Balance of Trade etc.

GDP:

The gross domestic product (GDP) or gross domestic income (GDI) is the sum total of market value of all final goods and services made within the borders of a country in a year. It is often positively correlated with the standard of living. GDP per capita is not an accurate measurement of the standard of living in an economy because all citizens would not benefit equally from their country’s increased economic production. However, the major advantage of GDP per capita as an indicator of standard of living is that it is measured frequently, widely and consistently.

GDP = private consumption + gross investment + government spending + (exports – imports)

Gross National Product (GNP) is the market value of all goods and services produced in one year by labor and property supplied by the residents of a country.

Gross national product (GNP) = GDP + (income receipts from the rest of the world – income payments to the rest of the world).

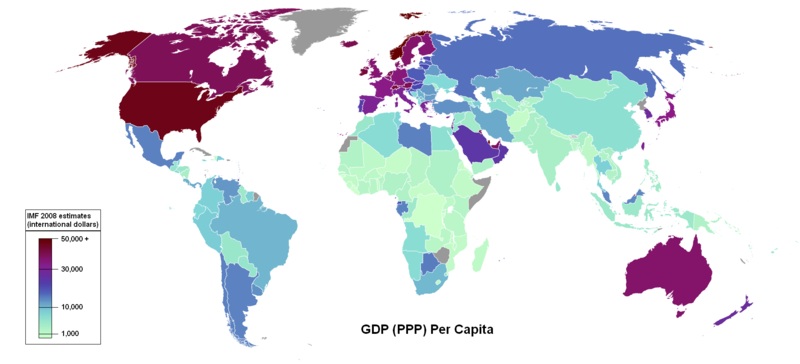

GDP (PPP) is GDP calculated by purchasing power parity which is believed on the concept that any good/service has same price in all countries and therefore compare living standard of all nations by taking into consideration cost of living and inflation. GDP (nominal) calculated by current exchange rates considers value of all goods with respect to international currency exchange rates and this nominal GDP is lower than GDP(PPP) in a country like India where Indian currency rupee is weaker as compared to dollar. GDP (PPP) of India is 3319 billion dollars. Nominal GDP by exchange rate of India is 1237 billion dollars. India is 4?th largest economy in the world by GDP (PPP). India is 12?th largest economy by GDP exchange rates.

Even though GDP is widely used by economists to gauge the health of an economy, this logic has many criticisms.

1) GDP does not take into account the disparity in incomes between the rich and the poor.

2) GDP excludes activities that are not provided through the market, such as household production and volunteer or unpaid services. As a result, GDP is understated.

3) Official GDP estimates may not take into account the underground economy, in which transactions contributing to production such as illegal trade and tax-avoiding activities are unreported, causing GDP to be underestimated.

4) GDP omits economies where no money comes into play at all, resulting in inaccurate or abnormally low GDP figures.

5) GDP ignores externalities or economic bads such as damage to the environment. By counting goods which increase utility but not deducting bads or accounting for the negative effects of higher production, such as more pollution, GDP is overstating economic welfare.

6) One main problem in estimating GDP growth over time is that the purchasing power of money varies in different proportion for different goods, so when the GDP figure is deflated over time, GDP growth can vary greatly depending on the basket of goods used and the relative proportions used to deflate the GDP figure.

7) It is just a measurement of economic activity and does not measure what is considered the sustainability of growth.

8) By not adjusting for quality improvements and new products, GDP understates true economic growth.

9) GDP ignores subsistence production.

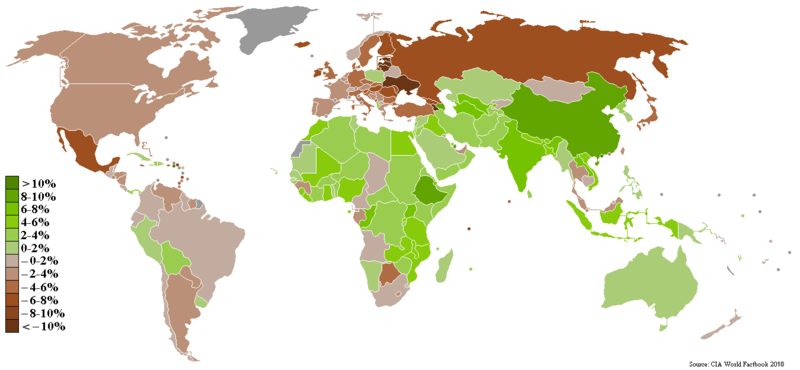

Economic growth:

Real GDP growth rate country-wise

Economic growth is a positive change in the level of production of goods and services by a country over a certain period of time. Nominal growth is defined as economic growth including inflation, while real growth is nominal growth minus inflation. The simplest definition of economic growth is an increase in real gross domestic product (that is, GDP adjusted for inflation). Economic growth rate means economic growth from one period to another in percentage terms. This measure does not adjust for inflation and it is expressed in nominal terms. In the United States, for example, the long-term economic growth rate is around 2-5%, this lower rate is seen in most highly industrialized countries. Fast-growing economies, on the other hand, see rates as high as 10% although this rate of growth is not likely to be sustainable over the long term. It can not be overemphasized that there is a very strong relationship between the increase in oil prices and real growth in the economy. Oil demand hit all time high of 88.3 million barrel a day in the last quarter. The growth in demand for this commodity is mainly led by fastest growing economies of India and China. With such a huge demand, it’s no wonder that prices have reached a rather uncomfortable level of US$ 90 a barrel. For purposes of evaluating how economic growth can feed into economic development it is often helpful to focus on the growth rate of GDP per capita – that is, output per person – rather than simply on overall output. For example, an economy that has a GDP growth rate of 4% and a population growth rate of 2% would have a per capita GDP growth rate of 2%. The per capita GDP growth rate is especially important because it indicates the actual increase in average income being experienced by the people of the country. If a country had a 2% GDP growth rate, but a 3% population growth rate, its per capita GDP growth rate would actually be negative, at -1%. The people would on average be getting poorer each year, even though the overall economy is growing. A more positive way of putting it is that, for people’s incomes on average to increase over time, the GDP growth rate must exceed the rate of population growth. I will give classical example of India. The Indian economy expanded at better than expected pace of 8.9 per cent in the second quarter of the current fiscal (July-September 2010), helped by strong performance of the farm and service sectors. From 2004 until 2010, India’s average quarterly GDP Growth was 8.37 percent reaching an historical high of 10.10 percent in September of 2006 and a record low of 5.50 percent in December of 2004. The inflation rate in India was last reported at 9.82 percent in September of 2010. From 1969 until 2010, the average inflation rate in India was 7.99 percent reaching an historical high of 34.68 percent in September of 1974 and a record low of -11.31 percent in May of 1976. Population growth rate is the average annual percent change in the population, resulting from a surplus (or deficit) of births over deaths and the balance of migrants entering and leaving a country. Current India population growth rate is 1.38 %. The real economic growth rate is the GDP growth on an annual basis adjusted for inflation and expressed as a percent. The Indian real GDP growth rate is 7.4 % for year 2010. This is valid provided India has a zero population growth rate but India has indeed 1.38 % population growth rate and therefore people are not getting richer as expected from GDP growth.

There is a difference between economic growth and economic development. Economic growth implies only an increase in quantitative output of goods & services while economic development refers to social and technological progress. Economic growth is measured by rate of change of GDP while economic development is measured by variety of indicators such as literacy rates, life expectancy, and poverty rates.

Job creation:

A job is the outcome of a business investing funds that create a need for a person to do some activity. According to search-matching theory, job creation in a firm should depend on the availability of workers (unemployment) and on the number of job openings in other firms (congestion). However, a study found that the job creation is an index of product-demand and not unemployment. The more is the demand for a product, more jobs will be created. More the demand of a product, more investment will be made in business and more jobs will be created to produce more goods & services to meet the growing demand. Of course, more demand for a product occurs when a consumer buys more products by spending more money. So increased consumer spending will lead to more demand for a product and more demand will lead to more investment and thence more jobs created. Remember, no middle-class person create employment out of thin air other than the successfully self-employed. Private sector jobs are created by private sector wealth. As wealth is invested back into the economy, jobs are necessarily created as economic activity increases, and the investors realize profits which they reinvest to continue the cycle.

Outsourcing:

A practice used by different companies to reduce costs by transferring portions of work (service & products) to outside suppliers rather than completing it internally. Companies that decide to outsource do so for a number of reasons, all of which are based on realizing gains in business profitability and efficiency. Principal merits of outsourcing include cost saving, minimize the fluctuations in staffing, focus on core competencies, financial flexibility, access to new technology and outside expertise, training current employees etc. However, major potential disadvantages to outsourcing include poor quality control, decreased company loyalty, a lengthy bid process, bad publicity, tied to the financial well-being of that company, loss of managerial control, hidden cost and a loss of strategic alignment. Also, outsourcing often eliminates direct communication between a company and its clients. This prevents a company from building solid relationships with their customers, and often leads to dissatisfaction on one or both sides. Indian Prime Minister Dr. Manmohan Singh made a strong statement on US criticism of sending US jobs to India. He stated, ‘India is not in the business of stealing jobs from the US.’ Outsourcing may be viewed by Indians as if the foreign companies are appreciating their expertise in the particular area. Sure they are, but more important to them is their cost reduction, and it’s an articulate statement given by them that countries like India can be hired very cheaply, even though their skills are world class. This is nothing but ridicule, but then outsourcing is a major reason for the boom of the service sector in India, and we cannot overlook the employment it provides. In fact, total work outsourced to India accounts for less than 1 percent of the country’s GDP. Outsourcing brings cost savings and increase in profits not only to business firms, but also benefits in macro-economic terms to the host country. According to McKinsey Global institute, out of the full $1.45 to $1.47 of the value created globally from off-shoring $1 of US labor cost, the US alone captures $1.12 to $1.14 of value while receiving countries like India capture on an average just 33 cents. This negates the most important argument against outsourcing that it results in loss of jobs in the host country as the activities which were performed in host countries or organizations are transferred to other locations.

Money:

Money is any object that is generally accepted as payment for goods & services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; of a store value; and, occasionally, a standard of deferred payment. The money supply of a country consists of currency (banknotes and coins) and demand deposits or ‘bank money’ (the balance held in checking accounts and savings accounts). These demand deposits usually account for a much larger part of the money supply than currency. Money is the most liquid asset because it is universally recognized and accepted as the common currency. In this way, money gives consumers the freedom to trade goods and services easily without having to barter. The control of the amount of money in the economy is known as monetary policy. Monetary policy is the process by which a government, central bank, or monetary authority manages the money supply to achieve specific goals. Usually the goal of monetary policy is to accommodate economic growth in an environment of stable prices. The tools used by central bank & government to control the money supply include: changing the interest rate at which the central bank loans money to (or borrows money from) the commercial banks, currency purchases or sales, increasing or lowering government borrowing, increasing or lowering government spending, manipulation of exchange rates, raising or lowering bank reserve requirements, regulation or prohibition of private currencies and taxation or tax breaks on imports or exports of capital into a country. A failed monetary policy can have significant detrimental effects on economy & society including hyperinflation, stagflation, recession, high unemployment, shortages of imported goods, inability to export goods, and even total monetary collapse and the adoption of a much less efficient barter economy. Electronic money (e-money) refers to money or scrip which is only exchanged electronically. Typically, this involves the use of computer networks, the internet and digital stored value systems. Electronic Funds Transfer (EFT) and direct deposit are all examples of electronic money.

Interest:

In economics, interest is considered the price of credit. Interest is a fee paid on borrowed assets. It is the price paid for the use of borrowed money, or, money earned by deposited funds. Assets that are sometimes lent with interest include money, shares, consumer goods through hire purchase, major assets such as aircraft, and even entire factories in finance lease arrangements. The percentage of the principal that is paid as a fee over a certain period of time (typically one month or year), is called the interest rate. Economically, the interest rate is the cost of capital and is subject to the laws of supply and demand of the money supply. Interest is compensation to the lender for a) risk of principal loss, called credit risk; and b) forgoing other useful investments that could have been made with the loaned asset. These forgone investments are known as the opportunity cost. Instead of the lender using the assets directly, they are advanced to the borrower. The borrower then enjoys the benefit of using the assets ahead of the effort required to obtain them, while the lender enjoys the benefit of the fee paid by the borrower for the privilege.

Inflation:

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation is also erosion in the purchasing power of money – a loss of real value in the internal medium of exchange and unit of account in the economy. Inflation’s effects on an economy are manifold and can be simultaneously positive and negative. Negative effects of inflation include a decrease in the real value of money and other monetary items over time, uncertainty over future inflation may discourage investment & savings, and high inflation may lead to shortages of goods if consumers begin hoarding out of concern that prices will increase in the future. Positive effects include a mitigation of economic recessions, and debt relief by reducing the real level of debt. Economists generally agree that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. Today, most mainstream economists favor a low steady rate of inflation. Low (as opposed to zero or negative) inflation may reduce the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduce the risk that a liquidity trap prevents monetary policy from stabilizing the economy. Inflation is usually estimated by calculating the inflation rate of a price index, usually the Consumer Price Index. High inflation can prompt employees to demand rapid wage increases, to keep up with consumer prices. Rising wages in turn can help fuel inflation. High or unpredictable inflation rates are regarded as harmful to an overall economy. They add inefficiencies in the market, and make it difficult for companies to budget or plan long-term. The Nobel Prize winning economist James Tobin at one point argued that a moderate level of inflation can increase investment in an economy leading to faster growth or at least a higher steady state level of income. This is because inflation lowers the real return on monetary assets relative to real assets, such as physical capital. To avoid this effect of inflation, investors would switch from holding their assets as money (or a similar, susceptible-to-inflation form) to investing in real capital projects. There is now broad agreement among economists that in the long run, the inflation rate is essentially dependent on the growth rate of money supply. Inflation can be controlled by various methods. The primary tool for controlling inflation is monetary policy. Most central banks are tasked with keeping the federal funds lending rate at a low level; normally to a target rate around 2% to 3% per annum, and within a targeted low inflation range, somewhere from about 2% to 6% per annum. A fixed exchange rate is usually used to stabilize the value of a currency and can be used as a means to control inflation. In India, when inflation spikes, the single focus of the government becomes controlling inflation. This is not how mature market economies work. In all mature market economies, the task of controlling inflation – and only the task of controlling inflation – is placed with the central bank. In mature market economies, inflation crises do not arise because the full power of monetary policy is devoted to this one task. With a sound monetary policy framework (for e.g. in India, stronger rupee & lower interest rate) inflation would be stabilized, inflation crises like the current one would not periodically hijack the government, and distortionary short-sighted initiatives such as banning exports of certain goods would not arise. In general, wage and price controls are regarded as a temporary and exceptional measure, only effective when coupled with policies designed to reduce the underlying causes of inflation. Salaries are typically adjusted annually in low inflation economies.

In context of economic development, inflation is desirable for two reasons: These are:

1) Inflation acts favorably upon the inducement of investment. The higher the price, the higher the expected price and the higher is the marginal efficiency of capital. As a result of this, the inducement to invest is higher too. Inflation thus boosts investment.

2) Inflation generates the necessary resources for investment. It forces people to save.

Inflation is inevitable in a developing economy because of the following reasons:

1) It can be shown that in a developing economy it is very difficult to obtain balanced growth (in the sense of equality between demand for and supply of consumer goods). Impossibility of balanced growth makes inflation inevitable.

2) In a developing economy there is an absence of an appropriate national consumption and wage policy. Thus a chaotic increase in wages leads to increase in demand for consumer goods. This disturbs the balance between supply and demand which eventually results in inflation;

3) In a developing country agricultural production is not very stable. There are periods of shortages and surpluses (though rarely). This results into higher prices. To avoid this , buffer stocks of food grains are built, but then this requires building of warehouses at strategic points, which in itself presents many problems including those of time-lag;

4) The impact of international prices (especially crude oil) cannot be avoided in developing countries, and this is therefore, also responsible for inflation in these countries.

Deflation:

In common usage deflation is generally considered to be “falling prices”. But there is much more to it than that. Often people confuse deflation with disinflation or with Depression (as in “the Great Depression”). These three terms are related but not synonymous. Deflation occurs when the annual inflation rate falls below 0% (a negative inflation rate). Inflation reduces the real value of money over time; conversely, deflation increases the real value of money – the currency of a national or regional economy. This allows one to buy more goods with the same amount of money over time.

Deflation is a decline in general price levels, often caused by a reduction in the supply of money or credit. Deflation can also be brought about by direct contractions in spending, either in the form of a reduction in government spending, personal spending or investment spending. Lower prices might sound appealing, making the cost of everything from cars to food to vacations cheaper. But prices decline because of a lasting drop in demand, which also means employers lower wages and consumers slow spending. It’s a combination that can drag down an economy for years. Deflation has often had the side effect of increasing unemployment in an economy, since the process often leads to a lower level of demand in the economy, exactly the opposite of inflation.

So there are four causes for Deflation.

1) Decreasing Money Supply

2) Increasing Supply of Goods

3) Decreasing Demand for Goods

4) Increasing Demand for Money

Actually, deflation itself is neither good nor bad. It depends on the cause of the deflation whether people will suffer or rejoice. If the cause is increasing supply of goods that would be good. Another example of this is in the late 1800’s as the industrial revolution dramatically increased productivity. However, if deflation is caused by a decreasing supply of money as in the great depression, that would be bad. The stock market crash sucked all the liquidity out of the market place, the economy contracted, and people lost their jobs and then banks stopped loaning money because people were defaulting. The problem compounded as more people lost their jobs and money supply fell further causing more people to lose their jobs, etc. etc.

Inflation versus deflation:

The following points bring out the fact that inflation is a lesser evil than deflation:

1) Inflation, though it redistributes income and wealth in the community in an unjust manner, does not reduce the national income of the community. Deflation, on the other hand, reduces the national income of the community and pauperizes society as a whole.

2) Deflation increases the level of unemployment in the economy, whereas inflation at least implies that all factors are employed in some way or another. Inflation is a post-full employment phenomenon; deflation is an under-employment phenomenon aggravating the problem of unemployment.

3) It is easy to control inflation by a clear money policy, coordinated by appropriate fiscal policy, but it is difficult to recover from deflation. Once a deflationary tendency starts, it increases business pessimism, the marginal efficiency of capital diminishes, and investment is contracted, and ultimately a severe depression sets in. Monetary policy becomes helpless here, and no amount of increase in the money supply can revive the price level and business expectations or marginal efficiency or capital in the economy during depression. On the other hand, an inflationary spiral can be reflated by controlling credit and money supply.

4) A mild inflation could stimulate economic development. The poverty in the midst of plenty can be overcome by raising the price level through the injection of more purchasing power by way of deficit financing of public investment programs.

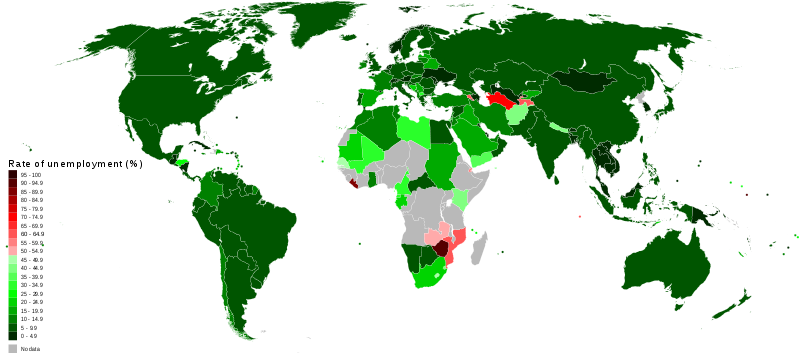

Unemployment:

Unemployment as defined by the International Labor Organization occurs when people are without jobs and they have actively looked for work within the past four weeks. The unemployment rate is a measure of the prevalence of unemployment and it is calculated as a percentage by dividing the number of unemployed individuals by all individuals currently in the labor force. In the year 2010, Indian unemployment rate is 10.7 % and the U.S. unemployment rate is 9.9%. The official unemployment rate in the 16 EU countries that use the euro rose to 10% in December 2009.

Factors responsible for unemployment are:

1) Rapid changes in technology

2) Recessions

3) Inflation

4) Disability

5) Undulating business cycles

6) Changes in tastes as well as alterations in the climatic conditions. This may in turn lead to decline in demand for certain services as well as products.

7) Attitude towards employers

8) Willingness to work

9) Perception of employees

10) Un-recognized Employee values

11) Discriminating factors in the place of work (may include discrimination on the basis of age, class, ethnicity, color and race).

12) Ability to look for employment

13) Welfare payments

14) Job dissatisfaction

15) Changes in work force due to baby-boom

Classical or real-wage unemployment occurs when real wages for a job are set above the market-clearing level, causing the number of job-seekers to exceed the number of vacancies. Most economists have argued that unemployment increases the more the government intervenes into the economy to try to improve the conditions of those with jobs. For example, minimum wage laws raise the cost of laborers with few skills to above the market equilibrium, resulting in people who wish to work at the going rate but cannot as wage enforced is greater than their value as workers becoming unemployed. Cyclical or Keynesian unemployment, also known as deficient-demand unemployment, occurs when there is not enough aggregate demand in the economy to provide jobs for everyone who wants to work. Demand for most goods and services falls, less production is needed and consequently fewer workers are needed, wages are sticky and do not fall to meet the equilibrium level, and mass unemployment results. Classical economists reject the conception of cyclical unemployment and alternatively suggest that the invisible hand of free markets will respond quickly to unemployment and underutilization of resources by a fall in wages followed by a rise in employment. Unemployment caused by supply-side factors results from imperfections in the labor market. A perfect labor market will always clear and all those looking for work will be working – supply will equal demand. However, if the market doesn’t clear properly there may be unemployment. This may happen because wages don’t fall properly to clear the market. Supply-side unemployment may also happen because there is occupational or geographical immobility. It may happen because there is poor information about job opportunities. Unemployed individuals are unable to earn money to meet financial obligations. Failure to pay mortgage payments or to pay rent may lead to homelessness through foreclosure or eviction. Unemployment increases susceptibility to malnutrition, diseases, mental stress, and loss of self-esteem, leading to depression and high divorce rates. High unemployment can encourage xenophobia and protectionism as workers fear that foreigners are stealing their jobs. Efforts to preserve existing jobs of domestic and native workers include legal barriers against “outsiders” who want jobs, obstacles to immigration, and/or tariffs and similar trade barriers against foreign competitors. High unemployment can also cause social problems such as crime. High levels of unemployment can be causes of civil unrest, in some cases leading to revolution, and particularly totalitarianism. Adolf Hitler’s rise to power, which culminated in World War II and the deaths of tens of millions and the destruction of much of the physical capital of Europe, is attributed to the poor economic conditions in Germany at the time, notably a high unemployment rate of above 20%. However, unemployment may have advantages notably; it may help avert inflation, which is argued to have damaging effects, by providing a reserve army of labor, which keeps wages in check. Demand side solutions include many countries aid the unemployed through social welfare programs. These unemployment benefits include unemployment insurance, unemployment compensation, welfare and subsidies to aid in retraining. The main goal of these programs is to alleviate short-term hardships and, more importantly, to allow workers more time to search for a job. In return, the country gets benefited from giving the jobless aid as the unemployed spends every dollar received from these helps which in turn drive the economy of the country as more cash flows into the business. However, unemployment benefits are spent on essentials. When you’re out of work, that’s all you can afford but they add to the deficit, whereas increased taxable income generated by more private sector jobs does not; and the only jobs created by unemployment benefits are in the deficit-fueled federal government and therefore to say that unemployment benefits boost economy is an overstatement. Supply side solutions include removing the minimum wage and reducing the power of unions. Supply-siders argue that such reforms increase long-term growth. This increased supply of goods & services requires more workers and so increasing employment. A study found that each 10 percent increase in the minimum wage is associated with a two to four percent decline in state GDP generated by lower-skilled industries. Although some economists tout minimum wage hikes as a form of stimulus to economy, the evidence shows otherwise. In fact proposal like minimum wage increases will fail to boost the economy and will certainly cause further job loss. It is argued that supply-side policies, which include cutting taxes on businesses and reducing regulation, create jobs and reduce unemployment. Other supply-side policies include education to make workers more attractive to employers.

What drives the machine of capitalism? It is a demand for goods & services and a return on investment, isn’t it? If people are unemployed, production of goods and provision of services falls off, and simultaneously, the people who are unemployed lack the finances to purchase goods and services. People who still have money, the investors, are reluctant to invest any money in the production of goods or the provision of services because when production and consumption are down, there is no opportunity to get a return on the investment. So unemployment leads to deflation and deflation worsens unemployment and the vicious cycle continues.

According to classical economic theory, markets reach equilibrium where supply equals demand; everyone who wants to sell at the market price can sell. Those who do not want to sell at this price in the labor market will cause classical unemployment. Increases in the demand for labor will move the economy along the demand curve, increasing wages and employment. The demand for labor in an economy is derived from the demand for goods & services and if the demand for goods & services in the economy increases, the demand for labour will increase, increasing employment and wages. Monetary policy and fiscal policy can both be used to increase short-term growth in the economy, increasing the demand for labor and decreasing unemployment.

Poverty:

Poor is not he, who has less, but poor is he, who wants more. So a “yogi” who has renounced whole world may be called “Rich “than a “King” who desires more. This is philosophy but reality is indeed bitter.

Is it enough to blame poor people for their own predicament? Have they been lazy, made poor decisions, and been solely responsible for their plight? What about their governments? Have they pursued policies that actually harm successful development? The poorest people will also have less access to health, education and other services. Problems of hunger, malnutrition and disease afflict the poorest in society. The poorest are also typically marginalized from society and have little representation or voice in public and political debates, making it even harder to escape poverty.

Absolute poverty means standard of living is sufficiently low to meet basic requirement of food, housing, clothing, health etc. Relative poverty is poverty of one person relative to richness of another person. A middle class person is poorer as compared to a rich person.

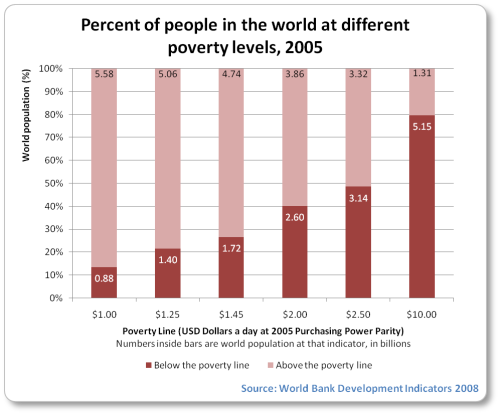

Poverty is the lack of basic human needs such as clean water, nutrition, health care, education, clothing and shelter, because of the inability to afford them. About 1.7 billion people live in absolute poverty in this world with near three-quarters of the world’s poor are rural farmers. Almost half the world – over 3 billion people – lives on less than $2.50 a day. 1 billion children live in poverty. The GDP of the 41 heavily indebted poor countries (567 million people) is less than the wealth of the world’s 7 richest people combined.

Below Poverty Line (BPL) is an economic benchmark and poverty threshold used by the government of India to indicate economic disadvantage and to identify individuals and households in need of government assistance and aid. Internationally, an income of less than $1 per day per head of purchasing power parity is defined as extreme poverty. Income-based poverty lines consider the bare minimum income to provide basic food requirements; it does not account for other essentials such as health care and education. That is why some times the poverty lines have been described as starvation lines. Different countries have different parameters to define BPL and even in a single country like India, different states have different parameters for BPL. The planning commission of India has calculated income-based BPL in the year 2005-06 and it was rupees 368 (8 dollars) per head per month in rural area and rupees 560 (13 dollars) per head per month in urban areas. This income is bare minimum to support the food requirements and does not provide much for the other basic essential items like health, education etc. Western nations will find these figures shocking.

World Bank’s definition of poverty:

Poverty is pronounced deprivation in well-being, and comprises many dimensions. It includes low incomes and the inability to acquire the basic goods and services necessary for survival with dignity. Poverty also encompasses low levels of health and education, poor access to clean water and sanitation, inadequate physical security, lack of voice, and insufficient capacity and opportunity to better one’s life. The World Bank defines extreme poverty as living on less than US $1.25 (PPP) per day, and moderate poverty as less than $2 a day. It estimates that in 2001, 1.1 billion people had consumption levels below $1 a day and 2.7 billion lived on less than $2 a day.

UN’s definition of poverty:

“Fundamentally, poverty is a denial of choices and opportunities, a violation of human dignity. It means lack of basic capacity to participate effectively in society. It means not having enough to feed and cloth a family, not having a school or clinic to go to; not having the land on which to grow one’s food or a job to earn one’s living, not having access to credit. It means insecurity, powerlessness and exclusion of individuals, households and communities. It means susceptibility to violence, and it often implies living on marginal or fragile environments, without access to clean water or sanitation”

Causes of poverty:

Before the industrial revolution, poverty had been mostly accepted as inevitable as economies produced little, making wealth scarce. In modern times, food shortages have been reduced dramatically in the developed world, thanks to agricultural technologies such as nitrogen fertilizers, pesticides and new irrigation methods. Also, mass production of goods in places such as China has made what were once considered luxuries, such as vehicles or computers, inexpensive and thus accessible to many who were otherwise too poor to afford them. Poor people spend a greater portion of their budgets on food than richer people. Threats to the supply of food may be caused by price rise, droughts, floods, natural disasters, and the water crisis. Overpopulation and lack of access to birth control methods drive poverty. However, the reverse is also true, that poverty causes overpopulation as it gives women little power to plan childhood, have educational attainment, or a career. The unwillingness of governments and feudal elites to give full-fledged property rights of land to their tenants is cited as the chief obstacle to development. Land reforms and giving land to landless farmers have helped significant segment of Indian population to come out of abject poverty. Poor economic development due to corruption, weak rule of law and excessive bureaucratic burdens promote poverty. Lack of industrialization result in poverty and also result in migration of people to other states to find jobs to alleviate poverty. Poor health and education severely affects productivity. Similarly substance abuse including alcoholism and drug abuse can consign people to vicious poverty cycles. Infectious diseases such as Malaria and Tuberculosis can perpetuate poverty by diverting health and economic resources from investment and productivity. War, political instability and crime including violent gangs and drug cartels, also discourage investment. Cultural factors, such as discrimination of various kinds, can negatively affect productivity such as age discrimination, stereotyping, gender discrimination, racial discrimination, and caste discrimination. Cutbacks in health, education and other vital social services around the world have resulted from structural adjustment policies prescribed by the International Monetary Fund (IMF) and the World Bank as conditions for loans and repayment. In addition, developing nation governments are required to open their economies to compete with each other and with more powerful and established industrialized nations. All of these enhance poverty. To attract investment, poor countries enter a spiraling race to the bottom to see who can provide lower standards, reduced wages and cheaper resources. This has increased poverty and inequality for most people. It also forms a backbone to what we today call globalization. As a result, it maintains the historic unequal rules of trade. Free, subsidized or cheap food, below market prices undercuts local farmers, who cannot compete and are driven out of jobs and into poverty. So primary factors that may lead to poverty include overpopulation, the unequal distribution of resources in the world economy, inability to meet high standards of living and costs of living, inadequate education and employment opportunities, environmental degradation, certain economic and demographic trends, and welfare incentives.

Increasingly, people talk about the ‘cycle of poverty’ that keeps the poor locked into poverty. Basically, because of the poverty that the poor are already experiencing, they and their children are not able to break out. Imagine that you are a six-year-old child in an impoverished family in India. Your parents might want to send you to school but are unable to do so because they need you to work so your family can be supported. Later on in life, when you try and get a job, you will be limited to low-paying occupations because of your lack of education. You will be forced into poverty once more.

Effects of poverty:

The effects of poverty may also be causes as listed above, thus creating a “poverty cycle” operating across multiple levels, individual, local, national and global. Hunger, disease, and less education describe a person in poverty. In my article on ‘The Intelligence’, I have shown that large segments of human populations are caught in the vicious cycle of poverty, higher fertility and lower intelligence. My own personal experience with the poor people of India & Saudi Arabia suggests that majority of poor people indeed live life in a rather uncivilized way. One third of deaths – some 18 million people a year or 50,000 per day – are due to poverty-related cause. According to the World Health Organization, hunger and malnutrition are the single gravest threats to the world’s public health and malnutrition is by far the biggest contributor to child mortality, present in half of all cases. Nearly half of all Indian children are undernourished. Poverty increases the risk of homelessness. There are over 100 million street children worldwide. Increased risk of drug abuse may also be associated with poverty. Research has found that there is a high risk of educational underachievement for children who are from low-income housing circumstances. Also, children who live at or below the poverty level will have far less success educationally than children who live above the poverty line. Poor children have a great deal less healthcare and this ultimately results in many absences from the academic year. Additionally, poor children are much more likely to suffer from hunger, fatigue, irritability, headaches, ear infections, flu, and colds. Poverty leads to poor housing. Slum-dwellers, who make up a third of the world’s urban population, live in poverty no better, if not worse, than rural people, who are the traditional focus of the poverty in the developing world, according to a report by the United Nations. According to a UN report on modern slavery, the most common form of human trafficking is for prostitution, which is largely fueled by poverty. Drug abuse can result in a community shouldering the impact of many nefarious acts such as stealing, killing, theft, sexual assault, and prostitution. Drug abuse is synonymous with poor performance in school & work, and a general malaise of intra-personal intelligence.

Poverty reduction:

Poverty reduction occurs largely due to economic growth which occurs due to industrial revolution and agricultural green revolution. In China and India, noted reductions in poverty in recent decades have occurred mostly as a result of the abandonment of collective farming in China and the cutting of government red tape in India. However, ending government sponsorship of social programs is sometimes advocated as a free market principle with tragic consequences. For example, the reconfiguration of public financing in former Soviet states during their transition to a market economy called for reduced spending on health and education which sharply increasing poverty. Empowering women has helped some countries increase and sustain economic development. Trade liberalization increases the total surplus of trading nations. Remittances sent to poor countries, such as India, are sometimes larger than foreign direct investment. Investments in human capital in the form of health are needed for economic growth. Nations do not necessarily need wealth to gain health. Human capital in the form of education is an even more important determinant of economic growth than physical capital. Many estimates suggest that a year of education raises earnings by about 10 percent or perhaps $80,000 in present value over the course of a lifetime. So education does reduce poverty. UN economists argue that good infrastructure, such as roads and information networks, helps market reforms to work. China claims it is investing in railways, roads, ports and rural telephones in African countries as part of its formula for economic development. It was the technology of the steam engine that originally began the dramatic decreases in poverty levels. Cell phone technology brings the market to poor or rural sections. With necessary information, remote farmers can produce specific crops to sell to the buyers that bring the best price. Technology also makes financial services accessible to the poor. Mobile banking addresses the problem of the heavy regulation and costly maintenance of saving accounts.

Efficient institutions that are not corrupt and obey the rule of law make and enforce good laws that provide security to property and businesses. Examples of good governance leading to economic development and poverty reduction include Thailand, Taiwan, Malaysia, South Korea, and Vietnam, which tends to have a strong government, called a hard state. Multinational corporations are regulated so that they follow reasonable standards for pay and labor conditions, pay reasonable taxes to help develop the country, and keep some of the profits in the country, reinvesting them to provide further development. Countries like India and Pakistan are soft states where lawlessness & corruption prevail upon business and lack of good governance leads to poverty.

Poverty in India:

India has 2.4 % of world’s area and less than 1.2 % of world’s income with 16.7 % of world’s population. Since 1972 poverty in India has been defined on basis of the money required to buy food worth 2100 calories in urban areas and 2400 calories in rural areas. According to a recent Indian government committee constituted to estimate poverty, nearly 38% of India’s population (380 million) is poor. This report is based on new methodology and the figure is 10% higher than the previous poverty estimate of 28.5%. Poverty is widespread in India, with the nation estimated to have a third of the world’s poor. According to a 2005 World Bank estimate, 42% of Indians falls below the international poverty line of US$ 1.25 a day (PPP). Despite significant economic progress, one quarter of the nation’s population earns less than the government-specified poverty threshold of 12 rupees per day (approximately US$ 0.25). A 2007 report by the state-run National Commission for Enterprises in the Unorganized Sector (NCEUS) found that 77% of Indians, or 836 million people, lived on less than 20 rupees (approximately US$0.50 nominal; US$2 PPP) per day. The average income in India was not much different from South Korea in 1947, but South Korea became a developed country by 2000s. At the same time, India was left as one of the world’s poorer countries. Causes of poverty in India include caste system, British rule, License Raj & red tape, over-reliance on agriculture, over-dependence on monsoon, population explosion, high illiteracy (35 % of adult population), corruption, lawlessness, bad governance etc.The Indian government and non-governmental organizations have initiated several programs to alleviate poverty, including subsidizing food and other necessities, increased access to loans, improving agricultural techniques and price supports, and promoting education and family planning and implementing number of antipoverty programs. However, late Indian Prime Minister Rajiv Gandhi once said that out of 100 paisa allocated for poor, only 14 paisa reaches them. In the year 1999-2000, the total subsidies provided by the central government were Rs 25,690 crore (Rs 256.9 billion), of which Rs 22,680 crore (Rs 226.8 billion) were for food and fertilizer. During the same year the central and state governments together spent another Rs 28,080 crore (Rs 280.8 billion) on “Rural Development,” “Welfare of SC, ST & OBCs” (Indian backward castes) and “Social Security and Welfare”. Given that poverty was between 26.1 per cent and 28.6 per cent, either of these if transferred directly to the poor & disadvantaged would have eliminated poverty but it did not. In 1991, after the International Monetary Fund (IMF) had bailed out the bankrupt state, the government of P. V. Narasimha Rao and his finance minister Manmohan Singh started breakthrough reforms. These new neo-liberal policies included opening for international trade and investment, deregulation, initiation of privatization, tax reforms, and inflation-controlling measures. The fruits of liberalization reached their peak in 2007, when India recorded its highest GDP growth rate of 9%. With this, India became the second fastest growing major economy in the world, next only to China. Due to economic liberalization in India, as of 2009, about 300 million people – equivalent to the entire population of the United States – have escaped extreme poverty. However, while only 5% of the 600,000 villages in the country have a commercial bank branch, half of India’s population is still financially excluded.

Aid:

Aid in its simplest form is a basic income grant, a form of social security periodically providing citizens with money. Critics argue that some of the foreign aid is stolen by corrupt governments and officials, and that higher aid levels erode the quality of governance. Policy becomes much more oriented toward what will get more aid money than it does towards meeting the needs of the people. Aid in the form of Immunization Programs for children such as against polio, diphtheria and measles have save millions of lives. A major proportion of aid from donor nations is tied, mandating that a receiving nation spend on products and expertise originating only from the donor country. Aid amounts are dwarfed by rich country protectionism that denies market access for poor country products while rich nations use aid as a lever to open poor country markets to their products. Most aid does not actually go to the poorest who would need it the most. One of the proposed ways to help poor countries has been debt relief. If poor countries do not have to spend so much on debt payments, they can use the money instead for priorities which help reduce poverty such as basic health-care and education.

Subsidy:

A subsidy is a form of financial assistance given either directly to a business & economic sector or indirectly to people by subsidizing price of kerosene, cooking gas and food. Subsidies can be regarded as a form of protectionism or trade barrier by making domestic goods and services artificially competitive against imports. Subsidies may distort markets, and can impose large economic costs. Subsidies to people by reducing prices of essential commodities may bring down cost of living but increase budget deficit.

Overpopulation & economy:

The ecosystem’s capacity for humans has been exceeded by a factor of ten and the amount of stored energy from the sun (including fossil fuels) used by humans is the equivalent of ten earths’ intake of usable solar energy for photosynthesis. So for a healthy ecosystem, only one tenth of today’s population is what thereby could survive sustainably. Basic economics would tell us that an increase in population ensures an increase in generation and consumption, providing stability. As simple as that sounds, what happens when we are consuming more than the earth can yield? If the world population continues to explode, the global economy will eventually have a serious problem with supply and demand as a result of our enormous per capita consumption of materials. Overpopulation has a definite effect on a country’s economy. First of all, when countries are overpopulated, the hardly have enough food to support themselves, never mind the hope of having a surplus to sell. This can contribute to a low GDP per capita which is the effect overpopulation has on the economy. In an attempt to save the people from the starvation, the government will most likely have to rely on foreign debt. This puts the country in debt at stretches the government’s already meagre resources. Furthermore, when a country is overpopulated, there is a high rate of unemployment because there just aren’t enough jobs to support the population. This results in a high level of crime because the people will need to steal things in order to survive. Governing an overpopulated country presents problems. The economy is stretched beyond belief, and civil wars break out.

Overpopulation leads to following economic effects:

1) Decreased per capita GDP and reduced standard of living due to ever increasing population.

2) Unemployment problems of serious dimension both in urban and rural areas leading to reduced per capita earning, poverty etc.

3) Increased inflation.

4) Increased borrowings from international organizations.

5) Difficulties encountered in implementation of all national and state developmental programs.

6) Increased government expenditure.

7) Drag on the social services (schools, hospitals, etc.) of the country.

However, some economists believe that poverty and famine are the result of greed and poor economic policies by governments around the world rather than from overpopulation. It isn’t that the earth doesn’t have the resources to feed the people on the planet, but that the elite have mishandled the resources and are the actual cause of poverty and famine throughout the world and not overpopulation. I disagree. Yes, it is true that greed & corruption steals money from economic development but overpopulation is equally bad. Let me put it differently. Overpopulation leads to increased demand for jobs which in turn leads to unemployment and high degree of unemployment leads to underground economy & crime as people have to support their families. We the honest taxpayers take a substantial double hit due to overpopulation because we pay more for our share of infrastructure, schools, hospitals & subsidies and we pay more for police, security agencies, jails and prisons to regulate and control illegal activities and warehouse lawbreakers. Also, overpopulation itself leads to corruption and corruption leads to poverty and poverty leads to overpopulation and so vicious cycle continues indefinitely. The only way to break this vicious cycle is to control population and good governance which the largest democracy India lacks at this moment in history.

Informal economy (parallel economy), black market & black money: